Introduction

In the vast landscape of investment options, mutual funds and stocks stand out as two of the most popular choices. Mutual funds offer a diversified portfolio managed by professionals, ideal for those who favor a more hands-off approach. On the other hand, stocks provide direct ownership in companies, granting investors the potential for higher returns along with greater control over their investments.

Choosing the right investment isn’t a one-size-fits-all decision—it hinges on your unique financial goals, risk tolerance, and the amount of time you’re willing to dedicate to managing your portfolio. Whether you’re seeking stability or eyeing aggressive growth, understanding the key differences between these investment vehicles is crucial.

This blog delves into a detailed comparison of mutual funds and stocks, empowering you with the insights needed to make an informed decision that aligns perfectly with your financial aspirations.

1. Understanding Mutual Funds and Stocks

Mutual Funds

Mutual funds are investment vehicles that pool money from many investors to create a diversified portfolio of assets, such as stocks, bonds, or other securities. This pooled fund is managed by professional fund managers who make the day-to-day investment decisions.

- Definition and How They Work:

When you invest in a mutual fund, you’re essentially buying a share of a large portfolio. The fund collects capital from various investors and then invests in a diversified range of assets according to a specific investment strategy. This setup allows for risk distribution across multiple securities, rather than betting on the performance of a single asset. - Active vs. Passive Management Strategies:

Mutual funds can be managed in two primary ways:- Active Management: Fund managers actively select securities and adjust the portfolio with the aim of outperforming the market. This strategy relies heavily on the manager’s expertise and research.

- Passive Management: These funds track a specific market index, such as the S&P 500, replicating its performance. Passive management generally results in lower fees and fewer transactions compared to actively managed funds.

Stocks

Stocks represent ownership in individual companies. When you purchase a stock, you acquire a share of the company, giving you a stake in its performance and potentially its profits.

- Definition and Ownership Concept:

Stocks are essentially equity investments. Owning a stock means holding a piece of the company, which could come with voting rights and dividends. This direct investment allows you to benefit from the company’s success through capital gains and, in some cases, dividend payouts. - How Stock Investments Work:

Investing in stocks involves researching and selecting individual companies based on various factors such as financial performance, market trends, and future growth potential. Stock prices fluctuate in the market, offering opportunities for significant returns—but also posing risks, as the value of your investment can drop if the company underperforms or market conditions change.

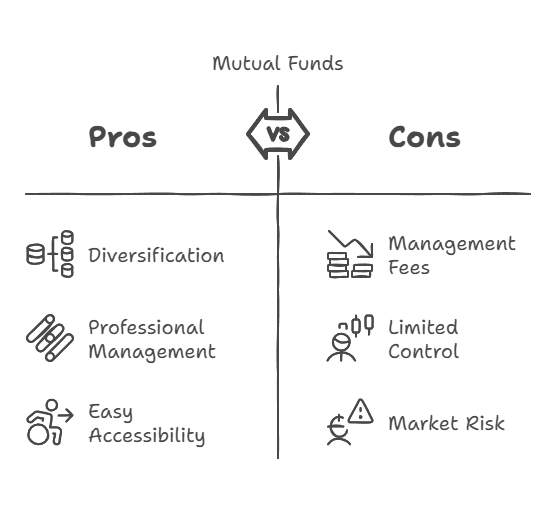

2 Advantages and Disadvantages of Mutual Funds

Mutual Funds

Advantages

Mutual funds are a popular choice for investors looking to build a diversified portfolio without the need to hand-pick individual securities. One of the key benefits is diversification, which helps spread risk across a variety of assets—reducing the impact of a poor-performing investment. Additionally, mutual funds offer professional management; seasoned fund managers are at the helm, making informed decisions based on extensive market research and analysis. This hands-off approach makes them especially attractive for those who prefer not to manage every aspect of their portfolio. Lastly, their easy accessibility ensures that investors can enter or exit the market with relative simplicity, making mutual funds a convenient option for many.

Disadvantages

However, investing in mutual funds is not without its drawbacks. The presence of management fees and expenses can erode returns over time, especially if the fund carries a high expense ratio. Investors also face limited control over investments since fund managers make the decisions about asset allocation and security selection. Moreover, mutual funds are not immune to market risk and fluctuations; despite the benefits of diversification, the underlying assets can still be impacted by broader market volatility.

Stocks

Advantages

- Higher Potential Returns:

Investing in stocks offers the chance for significant capital appreciation over time. The direct exposure to company performance means that if you pick the right stocks, you could benefit from substantial growth. - Flexibility and Control:

Stocks empower investors to handpick companies, manage entry and exit points, and tailor their portfolios to suit specific strategies. This level of control is ideal for those who enjoy actively managing their investments. - Greater Liquidity:

The stock market typically provides high liquidity, allowing investors to buy and sell shares quickly. This ease of trading means you can react promptly to market changes, seize new opportunities, or mitigate losses when necessary.

Disadvantages

- High Volatility and Risk:

Stocks are inherently more volatile compared to other investment vehicles. Prices can swing widely in the short term, and without proper risk management, investors may face steep losses during market downturns. - Requires Time and Knowledge for Research:

Successful stock investing demands continuous research and market analysis. Understanding a company’s fundamentals, industry trends, and broader economic factors is crucial and can be time-intensive, making it less suitable for investors seeking a hands-off approach. - Potential for Total Loss:

Investing in individual stocks carries the risk that a company may underperform or even collapse. In such cases, the entire investment in that company can be lost, underscoring the importance of diversification and risk management.

Read This Also : Intraday trading vs. long-term investing: Which is better?

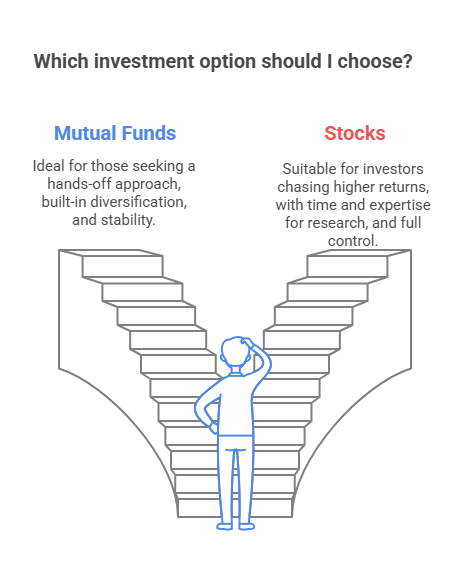

3. Mutual Funds vs. Stocks – Which One Should You Choose?

When it comes to building your investment portfolio, your decision hinges on your financial goals, risk tolerance, and the level of engagement you’re comfortable with. Here’s a straightforward breakdown to help guide you:

Choose Mutual Funds If:

- Hands-Off Approach: You’d rather let seasoned professionals manage the day-to-day decisions while you sit back and watch your investment grow.

- Built-In Diversification: You value a pre-packaged mix of assets that naturally spreads risk across a range of securities.

- Stability Over Volatility: You’re aiming for a more steady, less turbulent ride in the market, even if it might mean more modest returns.

Choose Stocks If:

- Chasing Higher Returns: You’re ready to embrace the ups and downs of the market for the potential of significant gains.

- Time and Expertise: You have the interest—and the know-how—to dive deep into company research, market trends, and financial analyses.

- Full Control: You want to handpick your investments and directly manage your portfolio’s direction.

This decision ultimately reflects your personal investing style and comfort with risk. Whether you lean towards the steady assurance of mutual funds or the dynamic potential of stocks, aligning your choice with your financial objectives is key.

4. Key Benefits of Investing in Mutual Funds

Professional Management:

Mutual funds are overseen by experienced fund managers who actively monitor market trends and adjust the portfolio to align with the fund’s objectives. This expert oversight is ideal for investors who prefer a hands-off approach, entrusting the complexities of market analysis and decision-making to professionals.

Risk Diversification:

One of the standout advantages of mutual funds is their inherent diversification. By pooling money from a variety of investors, these funds invest in a broad range of securities—spreading risk across different sectors and asset classes. This diversification helps cushion against the impact of poor performance in any single investment.

Affordability and Convenience:

Mutual funds typically require a lower minimum investment than purchasing a diverse portfolio of individual stocks. This makes them accessible to a wider range of investors, allowing you to start building wealth even with modest amounts of capital. Additionally, the ease of investing without needing to select individual securities simplifies the process for those new to the market.

Liquidity and Ease of Transactions:

Investors can easily buy or sell mutual fund shares on any business day, ensuring that their money remains relatively liquid. This straightforward redemption process offers quick access to funds when needed, making mutual funds a practical choice for those who value flexibility.

Cost-Effectiveness with Lower Operational Expenses:

Due to economies of scale, mutual funds often benefit from reduced expense ratios. With operational costs spread across a larger asset base, these funds tend to be a cost-effective investment option, helping maximize your net returns over time.

Regulatory Oversight Ensuring Transparency:

Mutual funds are subject to rigorous regulatory oversight, which helps maintain transparency and protects investor interests. This regulatory framework ensures that funds adhere to strict guidelines, providing an added layer of security and trust for investors.

Tax Benefits, Including Deductions Under Section 80C (for ELSS):

Investing in specific mutual funds, particularly Equity Linked Savings Schemes (ELSS), can offer attractive tax benefits. Under Section 80C of the Income Tax Act, investors may claim deductions up to ₹1.5 lakh per year, reducing taxable income while potentially enjoying favorable long-term capital gains treatment—all of which make ELSS a compelling option for the tax-conscious investor.

5. Tax Benefits of Mutual Funds in India

Equity Linked Savings Scheme (ELSS) and Tax Advantages

Investing in mutual funds, particularly through Equity Linked Savings Schemes (ELSS), offers significant tax benefits that can enhance your overall returns. Here’s how ELSS can work to your advantage:

- Deductions Under Section 80C:

ELSS investments allow you to claim a tax deduction of up to ₹1.5 lakh per annum. This deduction reduces your taxable income, potentially lowering your overall tax liability and increasing your net savings. - Shorter Lock-In Period:

Unlike many other tax-saving instruments that require a long-term commitment, ELSS funds have a lock-in period of just three years. This shorter duration offers greater flexibility, making it easier to access your funds sooner while still enjoying tax benefits. - Favorable Long-Term Capital Gains Tax Treatment:

Once you hold your ELSS investment for more than three years, the profits are classified as long-term capital gains. Gains above ₹1 lakh per financial year are taxed at a favorable rate of 10%, allowing you to benefit from both capital appreciation and a tax-efficient structure. - No Wealth Tax on Mutual Fund Holdings:

An additional advantage of ELSS is that your mutual fund holdings are exempt from wealth tax. This exemption further optimizes your investment strategy by reducing extra fiscal burdens.

These features make ELSS a compelling option for tax-conscious investors looking to achieve both growth and fiscal efficiency in their investment portfolios.

6. Conclusion: A Balanced Approach to Investing

Navigating the investment landscape means understanding that both mutual funds and stocks offer unique strengths—and limitations. The key takeaways are simple:

- Mutual Funds deliver professional management, diversification, and tax benefits, making them ideal for investors seeking a stable, hands-off approach.

- Stocks offer the promise of higher returns, liquidity, and the freedom to tailor your investments—but with increased volatility and risk.

A blend of both strategies can be a savvy move. Combining mutual funds with direct stock investments allows you to harness the stability and convenience of professional management while capturing the growth potential of individual companies. This balanced approach ensures that you’re not overly exposed to the unpredictable swings of the stock market, yet positioned to benefit from high-performing stocks when opportunities arise.

Ultimately, the best strategy aligns your portfolio with your personal financial goals, risk tolerance, and the time you can dedicate to market research. By carefully calibrating the mix, you can achieve a robust, diversified investment strategy that not only safeguards your capital but also positions you for long-term growth.

2 Responses