Introduction

India’s stock market is shaped by two major types of institutional investors—Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs). FIIs are global investment firms, hedge funds, and mutual funds that deploy foreign capital into Indian equities, whereas DIIs include domestic mutual funds, insurance companies, and pension funds that invest within the country.

The interplay between FIIs and DIIs plays a crucial role in determining market liquidity, volatility, and overall sentiment. FIIs bring in foreign capital, often driving market rallies, but their sudden withdrawals can trigger sharp corrections. On the other hand, DIIs act as stabilizers, cushioning market downturns by maintaining steady long-term investments, even when FIIs pull out.

For investors, understanding the impact of FII and DII activities is essential for making informed decisions. Their investment trends can indicate market direction, reveal economic confidence levels, and help retail investors navigate volatility. By tracking FII and DII movements, investors can better position themselves to capitalize on opportunities and mitigate risks in the ever-evolving stock market.

1. The Role of FIIs and DIIs in the Indian Stock Market

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) play crucial roles in shaping India’s stock market dynamics. While both bring substantial capital into the market, their investment approaches, risk appetites, and long-term impact differ significantly.

What Are FIIs?

Foreign Institutional Investors (FIIs) refer to overseas entities, such as mutual funds, hedge funds, pension funds, and sovereign wealth funds, that invest in Indian financial markets. These investors operate under the regulatory framework set by the Securities and Exchange Board of India (SEBI) and are typically driven by global economic trends, interest rates, and geopolitical events.

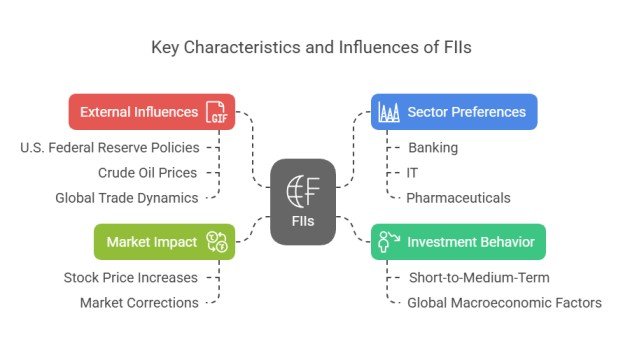

Key Characteristics of FIIs:

- Short-to-Medium-Term Investors: FIIs often enter and exit markets based on global macroeconomic factors rather than domestic fundamentals.

- High Sensitivity to External Factors: Changes in U.S. Federal Reserve policies, crude oil prices, and global trade dynamics significantly influence FII activity.

- Market Volatility: Large FII inflows can drive stock prices up, while sudden outflows can trigger sharp corrections.

- Sectoral Preferences: FIIs generally favor sectors with strong growth potential, such as banking, IT, and pharmaceuticals.

Sources of Capital & Investment Strategies:

FIIs raise funds from global institutional investors, including governments, corporations, and high-net-worth individuals (HNWIs). Their investment strategy revolves around:

- Emerging Market Opportunities: Investing in fast-growing economies like India to benefit from high returns.

- Arbitrage Trading: Taking advantage of currency fluctuations and stock price disparities across markets.

- Passive & Active Strategies: Some FIIs follow index-based investments, while others actively trade based on market trends.

What Are DIIs?

Domestic Institutional Investors (DIIs) include entities like mutual funds, insurance companies, pension funds, and banks operating within India. These investors are crucial for maintaining market stability, as their long-term investment approach helps counterbalance the volatility created by FIIs.

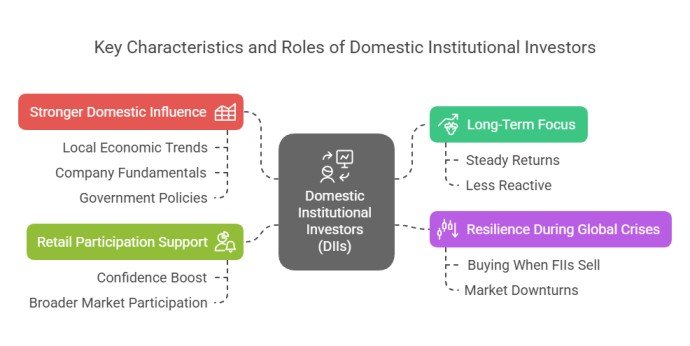

Key Characteristics of DIIs:

- Long-Term Focus: Unlike FIIs, DIIs prioritize steady returns over extended periods, making them less reactive to short-term market fluctuations.

- Resilient During Global Crises: DIIs tend to buy stocks when FIIs sell, as seen in market downturns like 2020 and 2022.

- Stronger Domestic Influence: DIIs have a deep understanding of local economic trends, company fundamentals, and government policies.

- Retail Participation Support: Their consistent investments encourage confidence among retail investors, boosting broader market participation.

Sources of Capital & Investment Strategies:

DIIs pool funds from domestic sources such as:

- Mutual Funds & Insurance Schemes: Investments made by Indian individuals through SIPs, ULIPs, and pension plans.

- Government & Private Pension Funds: Long-term institutional investments in stable and high-growth sectors.

- Banking & Financial Institutions: Direct equity investments and debt instruments supporting the broader economy.

DIIs primarily follow:

- Value Investing: Prioritizing fundamentally strong companies with sustainable growth.

- Sectoral Rotation: Adjusting investments based on economic cycles (e.g., favoring infrastructure in a growth phase).

- Contrarian Investing: Buying during downturns when FIIs exit, ensuring market stability.

How FIIs and DIIs Shape Market Movements

While FIIs bring in much-needed foreign capital, DIIs act as stabilizers against external market shocks. Their combined influence dictates liquidity, stock valuations, and overall market sentiment. Understanding their investment behavior is essential for both institutional and retail investors to navigate market trends effectively.

2. Market Liquidity and Volatility

FII Influence: Liquidity Injection and Market Volatility

Foreign Institutional Investors (FIIs) play a crucial role in driving liquidity in the Indian stock market. Their large-scale investments bring in foreign capital, increasing market participation and enhancing price movements. However, this liquidity influx comes with a downside—heightened volatility. Since FIIs often react to global economic conditions, their investment patterns can lead to sharp market swings.

A prime example of this was observed in March 2025, when FIIs initially sold ₹24,256 crore worth of stocks, causing a significant market correction. However, towards the end of the month, they reversed course with a net inflow of ₹1,463 crore, leading to a 1.5% rally in the Sensex. This showcases how FII actions can swiftly shift market sentiment, causing fluctuations that impact both retail and institutional investors.

Additionally, external factors like U.S. Federal Reserve interest rate changes, geopolitical tensions, and global economic outlooks heavily influence FII behavior. A sudden FII sell-off can trigger panic in the market, causing sharp declines in stock prices, as seen during the 2022 FII exodus, when they pulled out $16.5 billion, leading to significant market corrections.

DII Influence: Market Stability and Counteracting Sell-offs

While FIIs often amplify volatility, Domestic Institutional Investors (DIIs) act as a stabilizing force by counterbalancing FII outflows. DIIs, including mutual funds, insurance companies, and pension funds, have a long-term investment outlook, reducing the risk of panic-driven market fluctuations.

For instance, in March 2025, even as FIIs offloaded stocks worth ₹24,256 crore, DIIs stepped in with a massive ₹34,479 crore investment, cushioning the market from excessive downturns. This intervention ensured that investor confidence remained intact and prevented a major collapse.

A similar trend was observed during the 2022 FII sell-off, where DIIs absorbed a record ₹2.76 lakh crore of FII withdrawals, preventing a steeper decline in stock indices. Their continued support during global crises reassures retail investors and mitigates the impact of foreign capital flight.

Overall, while FIIs bring liquidity and drive short-term market trends, DIIs ensure market stability, making them a crucial force in maintaining long-term growth and investor confidence in the Indian stock market.

3. Price Discovery and Market Sentiment

FII Buying & Selling Trends

Foreign Institutional Investors (FIIs) play a crucial role in shaping market sentiment as their investment patterns often reflect global confidence in India’s economic growth. When FIIs inject capital into Indian equities, it signals strong international trust in the country’s economic potential, leading to a surge in market valuations. Conversely, large-scale FII withdrawals can create bearish conditions, as seen during periods of global uncertainty.

For example, in 2023, FIIs pumped $20 billion into Indian markets, reinforcing optimism about India’s economic resilience and growth prospects. This influx of foreign capital contributed to record-high stock market valuations and boosted investor sentiment. However, in 2022, FIIs withdrew $16.5 billion, leading to temporary market declines as concerns over global interest rate hikes and recession fears caused foreign investors to pull back. Such cycles demonstrate how FII movements can act as a barometer of global confidence in India’s economy.

DII Activity & Domestic Confidence

In contrast to FIIs, Domestic Institutional Investors (DIIs) often serve as stabilizers during market fluctuations, reflecting strong long-term confidence in India’s economic fundamentals. Their investment behavior is primarily driven by local factors, such as economic growth, corporate earnings, and government policies, rather than short-term global trends.

During market downturns, DIIs have consistently stepped in to counterbalance FII outflows. A prime example was March 2020, when COVID-19-induced panic led to a sharp market correction. While FIIs sold aggressively, DIIs invested ₹55,595 crore, helping the market recover more quickly than expected. A similar trend occurred in March 2025, when FIIs initially withdrew ₹24,256 crore, contributing to market volatility. However, DIIs responded with a massive ₹34,479 crore investment, absorbing the sell-off and stabilizing the market.

These instances highlight how DIIs act as a backbone for India’s stock market, ensuring that domestic confidence remains intact even when foreign capital fluctuates. Their consistent buying patterns encourage retail participation and long-term market stability, making them a critical force in India’s evolving investment landscape.

Read This Also: How to analyze a stock before investing (Fundamental vs. Technical analysis)

4. Structural Impact of FIIs and DIIs

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) play distinct yet complementary roles in shaping the Indian stock market’s structure. Their investment strategies, ownership patterns, and reactions to market events significantly influence overall market stability.

Investment Horizon

- FII Influence: FIIs typically follow a short-to-medium-term investment strategy, reacting swiftly to global economic trends, interest rate changes, and geopolitical developments. Their tendency to move capital in and out of markets based on external conditions can lead to sudden market fluctuations.

- DII Influence: DIIs, on the other hand, adopt a long-term investment approach, prioritizing fundamental analysis over short-term market sentiment. Investments by insurance firms, pension funds, and mutual funds reflect their preference for steady, sustainable growth rather than speculative trading.

Ownership Trends

- FII Influence: As of 2023, FIIs collectively held about 15% of India’s total market capitalization, making them a significant force in shaping stock valuations. Their preference for high-growth sectors like banking, IT, and pharmaceuticals often drives sectoral performance.

- DII Influence: DIIs, including mutual funds, insurance companies, and pension funds, accounted for 36% of market ownership, supported by strong domestic savings and retail participation. Their increasing presence in equity markets reflects India’s transition towards self-reliance in capital formation.

Regulatory Limits

- FII Influence: FIIs are subject to regulatory constraints, including a 24% cap on their stake in individual companies, unless specifically increased by the company’s board. These restrictions are aimed at preventing excessive foreign control over key industries.

- DII Influence: Unlike FIIs, DIIs face no ownership restrictions, allowing them to acquire larger stakes in Indian companies. This regulatory flexibility enables them to provide stable, long-term capital support to domestic businesses.

Crisis Response

- FII Influence: FIIs are often the first to exit during global economic downturns, contributing to sharp sell-offs and increased volatility. For example, FIIs withdrew ₹2.76 lakh crore during 2022’s market downturn, leading to significant corrections in stock prices.

- DII Influence: DIIs act as market stabilizers, counterbalancing FII outflows by increasing their investments during periods of distress. Their role was evident in 2022, when they absorbed large-scale FII withdrawals, and again in March 2025, when DIIs invested ₹34,479 crore to support market stability.

In essence, while FIIs bring liquidity and global expertise, their short-term focus can lead to volatility. DIIs, with their long-term vision, provide resilience, ensuring market stability even during periods of global uncertainty.

5. Economic and Corporate Governance Effects

Capital Inflows & Market Development

Foreign Institutional Investors (FIIs) play a crucial role in bridging investment gaps in the Indian stock market. Their inflows provide much-needed capital for businesses, enabling expansion, innovation, and economic growth. FIIs also contribute to the development of financial instruments such as derivatives, exchange-traded funds (ETFs), and currency hedging mechanisms, which enhance market efficiency and depth. Their participation in large-scale public offerings and secondary markets helps improve liquidity, making it easier for companies to raise funds.

Corporate Governance Standards

FIIs, with their exposure to international markets, push Indian companies toward adopting global best practices in corporate governance. Many foreign investors prioritize transparency, ethical business practices, and shareholder rights before investing. This pressure encourages Indian firms to improve financial disclosures, adhere to strict auditing standards, and implement robust risk management frameworks. As a result, the presence of FIIs has contributed to greater investor confidence and a more mature corporate ecosystem in India.

Balance of Payments

FIIs significantly impact India’s balance of payments by influencing foreign exchange reserves. When FIIs invest in Indian equities, they bring in foreign currency, strengthening forex reserves and stabilizing the rupee. These inflows help manage India’s current account deficit and provide a cushion against external economic shocks. However, heavy FII outflows, especially during global crises, can lead to rupee depreciation and increased market volatility. In contrast, Domestic Institutional Investors (DIIs) reduce India’s dependence on foreign capital by consistently investing in the stock market. Their growing influence, with a 36% share in market activity (2023), provides stability and minimizes the adverse effects of FII-driven volatility.

6. Recent Trends in FII and DII Activity (2024–2025)

Reduced FII Dependence: The Rise of Domestic Investments

In recent years, India’s stock market has become less reliant on FII inflows, thanks to the growing dominance of DIIs and retail investors. In 2025, DIIs accounted for 36% of market activity, acting as a cushion against FII volatility. A prime example is the March 2025 rally to 75,301 on the Sensex, driven by ₹2,028 crore daily DII buying, despite inconsistent FII participation. This shift indicates India’s growing self-sufficiency in capital markets, reducing the impact of global economic uncertainties on domestic stock movements.

Sectoral Preferences: Diverging Investment Strategies

FIIs and DIIs tend to favor different sectors, shaping stock market trends in distinct ways:

- FIIs favor banking and IT due to their high liquidity and global integration. These sectors provide exposure to India’s digital economy and financial growth.

- DIIs focus on consumption and infrastructure sectors, reflecting domestic economic expansion. Investments in FMCG, manufacturing, and real estate indicate confidence in long-term domestic demand.

This sectoral divergence helps stabilize market performance, ensuring that different segments receive sustained investment even during FII pullbacks.

Regulatory Evolution: SEBI’s Offshore Fund Norms vs. RBI’s FII Limits

Regulatory changes have played a crucial role in shaping FII and DII participation:

- SEBI relaxed offshore fund norms in 2024, making it easier for foreign investors to participate in India’s stock market. This move aims to attract more stable, long-term FII inflows rather than short-term speculative capital.

- RBI maintains a 24% sectoral cap on FII ownership, limiting foreign stakes in Indian companies to ensure domestic control over critical sectors. This policy prevents excessive FII influence on key industries while allowing room for sustained foreign investment.

These regulatory shifts highlight India’s balanced approach—encouraging foreign investment while strengthening domestic financial resilience.

7. Key Takeaways for Investors

Investors need to be nimble and informed in today’s dynamic market. Here are the key insights to keep front and center:

- Tracking FII/DII Data:

Monitoring the daily ebb and flow of FII and DII investments can serve as a reliable barometer of market sentiment. Sharp shifts or persistent trends often foreshadow broader market movements, making this data indispensable for anticipating trend reversals and identifying investment opportunities. - Balanced Portfolios:

A diversified portfolio that blends FII-heavy stocks with those bolstered by DII backing can help cushion against volatility. FIIs often bring short-term dynamism, while DIIs provide a steadying influence. Striking the right balance not only mitigates risk but also positions investors to tap into both global and domestic growth avenues. - DII Dominance as a Maturity Signal:

The increasing prominence of DIIs—reflected in significant domestic inflows—signals a maturing financial market. This shift suggests a transition towards a more self-sustaining market dynamic, one that is less vulnerable to the whims of global capital flows and more reflective of India’s long-term economic fundamentals.

These insights empower investors to build resilient strategies and navigate market complexities with a nuanced understanding of both domestic and international influences.

Conclusion

In a dynamic market like India’s, FIIs and DIIs play distinct yet interlinked roles in shaping market behavior. FIIs, with their swift and sizable capital movements, infuse the market with liquidity but also amplify volatility, reflecting global economic and geopolitical sentiments. Conversely, DIIs provide a stabilizing counterbalance through sustained, long-term investments that not only temper sudden market shocks but also signal robust domestic confidence.

For investors, keeping a close eye on these investment flows is indispensable. By tracking FII and DII activity, one can gauge underlying market sentiment, anticipate potential shifts in liquidity, and better navigate the inherent volatility of the market. In essence, a well-informed perspective on these flows equips investors with a critical edge in crafting resilient, balanced portfolios.