Rupee ke liye yeh saal kaafi turbulent raha hai, aur pressure pichle hafte aur badh gaya jab yeh pehle baar 90-per-dollar mark ko paar kar gaya. January se ab tak 5 percent girawat ke saath, yeh currency ab Asia mein worst performer ban chuki hai.

Is haalat mein, RBI ne aggressively beech mein aakar kuch kadam uthaye. Inmein shamil hain:

- 25 bps rate cut

- Rs 1 lakh crore ka open-market bond purchase

- $5 billion ka buy–sell swap dollar ki tangi (tightness) ko kam karne ke liye.

In steps se nerves toh calm hue hain, lekin ab sabki nazar is hafte US Federal Reserve ke policy decision par hai.

Traders poori tarah se expect kar rahe hain ki Fed apni December 9–10 meeting mein 25 bps rate cut karega. Generally, US rates kam hone se dollar weak hota hai aur rupee jaise emerging market currencies ko support milta hai. Par analysts warn kar rahe hain ki is baar iska asar bahut kam (far more muted) ho sakta hai.

❓ Kyun Fed Rate Cut Kaafi Nahi Hoga?

Theoretically, softer dollar se rupee ko saans lene ki jagah (breathing room) milti hai. US yields kam hone se foreign investors higher-yielding emerging markets ki taraf aate hain, jisse capital aata hai aur local currency ko support milta hai.

Lekin analysts ka kehna hai ki Fed ka rate cut already ‘priced in’ ho chuka hai. Iska matlab hai ki rupee mein koi significant bounce tab tak nahi aayega jab tak broader conditions favorable nahi ho jaate.

Current situation:

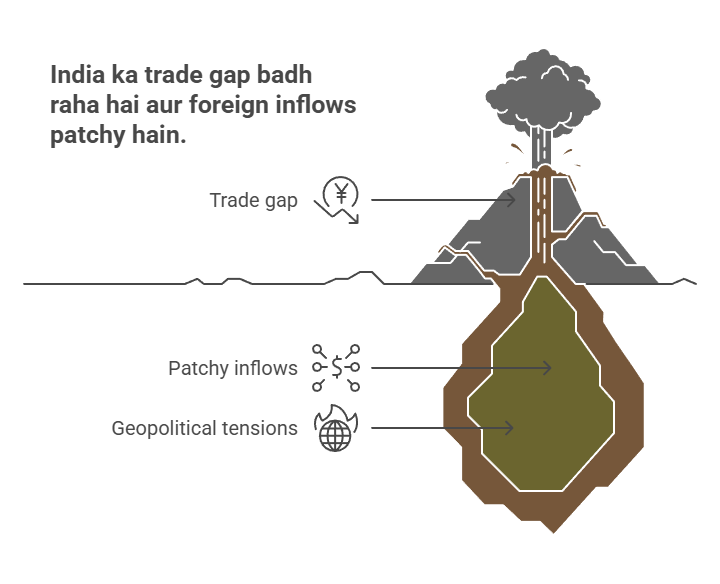

- India ka trade gap badh raha hai (widening).

- Foreign inflows abhi bhi patchy hain.

- Geopolitical tensions ke beech global investors cautious hain.

Inn factors ki wajah se meaningful rupee appreciation ke chances kam hain, bhale hi US rate cut ho jaye.

Bhavik Patel, senior commodities analyst at Tradebulls Securities ne kaha, “Fed rate cuts currency markets mein already factor in ho chuke hain, aur jab tak India-US trade deal nahi hoti, rupee ki direction mein kuch khaas change nahi aayega.”

October mein India ka record trade deficit aur sluggish global demand batata hai ki rupee structural challenge face kar raha hai, na ki koi temporary problem.

📉 Weak Inflows Ka Bhaar

Foreign investment (FPI aur FDI dono) is saal uneven raha hai, jisse rupee ko kam support mila hai. Analysts ko lagta hai ki agar global volatility kam hoti hai toh inflows badh sakte hain, lekin filhaal, weak participation negative khabaron ke liye currency ki sensitivity ko badha raha hai.

Jigar Trivedi, senior analyst at Reliance Securities ne kaha, “RBI ka liquidity injection aur neutral policy stance temporary relief de sakta hai, lekin weak foreign inflows aur wide trade deficit kisi bhi strong appreciation ko rokenge.” Unke hisaab se is hafte 89.3–90.4 levels dekhne laayak honge.

Aamir Makda, commodity aur currency analyst at Choice Broking ne kaha ki Fed ka cut rupee ke liye “marginally positive” ho sakta hai. Unka anuman hai ki USD/INR agle hafte “90 ke upar sustain” karega, jismein 88.2–87.5 key support levels rahenge.

Situation isliye bhi clouded hai kyunki US dollar index mein haal ke mahino mein koi dramatic surge nahi aaya hai. Iska matlab hai ki rupee ki weakness broad dollar strength ki wajah se nahi hai, balki India-specific factors ki wajah se hai:

- Imports ke liye increased dollar demand

- Corporate hedging

- External debt repayments

Global investors bhi safer assets ki talash mein hain, jisse emerging markets mein flows limit ho rahe hain.

Fed rate cut se volatility zaroor cool ho sakti hai, lekin rupee mein strong aur sustained rebound tab tak mushkil lagta hai jab tak India ka trade deficit kam nahi hota aur foreign inflows meaningful way mein wapas nahi aate. Filhaal, rupee tight spot mein hai: stabilisation possible hai, lekin deeper recovery out of reach lagti hai.