Introduction

Investing in the stock market requires more than just picking stocks based on trends or recommendations. A thorough analysis of a stock before investing helps minimize risks and maximize potential returns. Investors primarily use two approaches for stock evaluation: fundamental analysis and technical analysis.

Fundamental analysis focuses on a company’s financial health, intrinsic value, and long-term growth potential. It involves examining financial statements, economic conditions, and management quality to determine whether a stock is undervalued or overvalued.

On the other hand, technical analysis relies on historical price movements, trading volume, and chart patterns to predict future stock price trends. It is commonly used by traders looking to capitalize on short-term price fluctuations.

While these two methods differ in approach, they can also be used together to create a well-rounded investment strategy. Fundamental analysis helps investors select fundamentally strong stocks, while technical analysis assists in identifying the best entry and exit points. By combining both, investors can make informed decisions that balance long-term growth with optimal timing.

Read More: How to invest in mutual funds vs stocks – Which one is better?

1. Understanding Fundamental Analysis

1.1 What is Fundamental Analysis?

Fundamental analysis is a method of evaluating a stock’s intrinsic value by analyzing financial and economic data. This approach helps investors determine whether a stock is overvalued, undervalued, or fairly priced based on its true financial health rather than short-term market fluctuations.

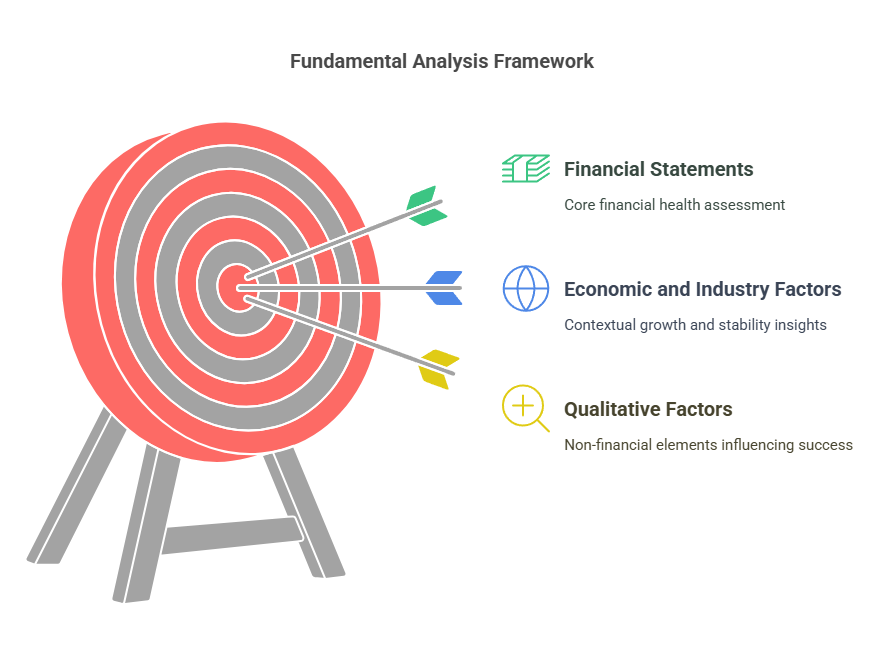

Fundamental analysis relies on three key aspects:

- Financial Statements: Investors examine a company’s income statement, balance sheet, and cash flow statement to assess profitability, debt levels, and liquidity. Key financial ratios, such as the P/E ratio, D/E ratio, and ROE, help gauge a company’s performance and stability.

- Economic and Industry Factors: Broader economic indicators like GDP growth, inflation, and interest rates, along with industry-specific trends, provide insights into the company’s growth potential and competitive position.

- Qualitative Factors: Non-financial elements, such as management quality, brand strength, and competitive advantages, also play a crucial role in evaluating a company’s long-term success.

By combining these elements, fundamental analysis helps investors make informed, long-term investment decisions, identifying stocks that have strong financial foundations and potential for sustainable growth.

1.2 Key Components of Fundamental Analysis

Fundamental analysis relies on various financial and economic indicators to determine a stock’s intrinsic value. Investors use financial statements, key ratios, and industry trends to assess a company’s health and growth potential.

1.2.1 Financial Statements & Ratios

A company’s financial statements provide crucial insights into its performance, profitability, and financial stability. The three core financial statements used in fundamental analysis are:

1. Income Statement

The income statement shows a company’s revenues, expenses, and net income over a specific period. It helps investors evaluate profitability and operational efficiency.

- Key Metrics: Revenue, Gross Profit, Operating Income, Net Profit

2. Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a given point in time. It details assets, liabilities, and shareholder equity.

- Key Metrics: Total Assets, Total Liabilities, Shareholder Equity

3. Cash Flow Statement

The cash flow statement tracks cash movements in and out of a company, categorizing them into operating, investing, and financing activities. It helps assess liquidity and cash management.

- Key Metrics: Operating Cash Flow, Free Cash Flow

Important Financial Ratios

Financial ratios simplify complex financial data, allowing investors to compare companies and evaluate their financial health.

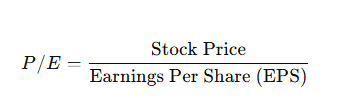

1. Price-to-Earnings (P/E) Ratio

The P/E ratio measures how much investors are willing to pay for each dollar of earnings a company generates.

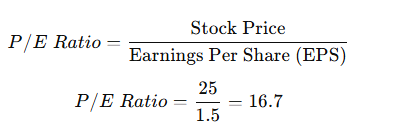

- Formula:

- Interpretation:

- A high P/E may indicate overvaluation or high growth expectations.

- A low P/E may suggest an undervalued stock or lower growth potential.

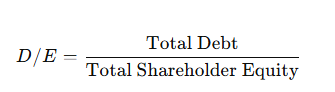

2. Debt-to-Equity (D/E) Ratio

The D/E ratio evaluates a company’s financial leverage by comparing its total debt to shareholder equity.

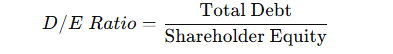

- Formula:

- Interpretation:

- A high D/E ratio indicates heavy reliance on debt, which can be risky.

- A low D/E ratio suggests a more stable financial structure.

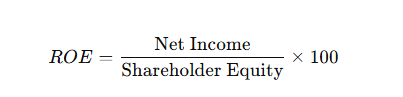

3. Return on Equity (ROE)

The ROE measures a company’s ability to generate profit from shareholder investments.

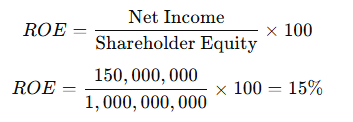

- Formula:

- Interpretation:

- A high ROE reflects strong profitability and efficient use of equity.

- A low ROE suggests poor returns for investors.

By analyzing these financial statements and key ratios, investors can determine whether a stock is fundamentally strong and worth investing in for long-term gains.

1.2.2 Economic and Industry Factors

Stock performance is heavily influenced by broader economic conditions and industry-specific trends. Investors use macroeconomic indicators to assess the overall health of the economy and predict how market conditions might impact a company’s future growth. Below are key factors to consider:

1. GDP Growth

- Why It Matters: Gross Domestic Product (GDP) measures a country’s economic activity. Higher GDP growth signals a strong economy, increasing consumer and business spending, which benefits most companies.

- Impact on Stocks:

- High GDP Growth: Boosts corporate earnings, leading to rising stock prices.

- Low or Negative GDP Growth (Recession): Reduces consumer demand and business profits, often leading to stock price declines.

2. Inflation

- Why It Matters: Inflation represents the rate at which prices of goods and services rise. Moderate inflation is normal, but excessive inflation erodes purchasing power and increases costs for businesses.

- Impact on Stocks:

- High Inflation: Reduces profit margins as companies face rising costs for materials and labor. This often leads to lower stock prices.

- Low to Moderate Inflation: Generally favorable for businesses, as it indicates steady economic growth without excessive cost pressures.

- Deflation (Falling Prices): Can signal economic stagnation, leading to lower revenues and declining stock values.

3. Interest Rates (Influenced by Central Banks)

- Why It Matters: Central banks (e.g., RBI, Federal Reserve) adjust interest rates to control inflation and economic growth.

- Impact on Stocks:

- Higher Interest Rates: Increase borrowing costs for businesses, reducing profits and stock prices.

- Lower Interest Rates: Encourage borrowing and investment, often leading to stock market growth.

4. Industry-Specific Trends

- Why It Matters: Some industries perform better in certain economic conditions. For example, technology stocks may thrive in high-growth environments, while utility stocks perform well during economic downturns.

- Impact on Stocks:

- Booming Industry: Stocks in high-growth industries (e.g., AI, renewable energy) tend to outperform.

- Declining Industry: Stocks in struggling industries (e.g., traditional retail, fossil fuels) may face long-term declines.

Key Takeaway

Understanding economic and industry factors helps investors anticipate market conditions and make informed stock selections. Companies operating in strong economies and growing industries generally analyze a stock before investing offer better long-term investment potential than those facing economic headwinds.

1.2.3 Qualitative Factors

While financial metrics provide a numerical assessment of a company’s health, qualitative factors offer insight into aspects that numbers alone cannot capture. These include management quality, competitive advantage, and brand strength, all of which significantly impact a company’s long-term success.

1. Management Quality

The competence and vision of a company’s leadership play a crucial role in its growth and stability. Investors should assess:

- Experience & Track Record – Have the CEO and executive team successfully managed other companies?

- Decision-Making & Strategy – Are they making informed, forward-looking business decisions?

- Corporate Governance – Does the company operate with transparency, ethical business practices, and strong shareholder relations?

For example, companies with visionary leaders like Warren Buffett (Berkshire Hathaway) or Satya Nadella (Microsoft) have consistently outperformed the market due to strong leadership.

2. Competitive Advantage

A company’s ability to maintain a competitive edge determines its sustainability in the market. Key factors include:

- Unique Products or Services – Does the company offer something difficult for competitors to replicate? (e.g., Apple’s ecosystem)

- Market Share & Positioning – Is the company a market leader or a disruptor?

- Economies of Scale & Cost Efficiency – Can the company produce goods/services at a lower cost than competitors?

A strong competitive advantage allows a business to fend off competitors and maintain profitability even during economic downturns.

3. Brand Strength & Customer Loyalty

A powerful brand fosters consumer trust, pricing power, and long-term growth. Investors should consider:

- Brand Recognition – How well-known is the company’s brand in its industry? (e.g., Coca-Cola, Nike)

- Customer Loyalty & Retention – Does the company have repeat customers and a strong community? (e.g., Apple’s iPhone users)

- Reputation & Public Perception – How does the brand handle crises, controversies, and changing consumer trends?

A well-established brand with loyal customers can sustain growth and profitability even in competitive markets.

By evaluating these qualitative factors alongside financial data, investors gain a more holistic understanding of a company’s long-term potential, ensuring well-informed investment decisions.

1.3 Pros and Cons of Fundamental Analysis

Fundamental analysis offers a comprehensive approach to evaluating a company’s financial health, long-term potential, and industry position. However, like any method, it has both advantages and limitations.

Pros

- Provides a long-term perspective

Fundamental analysis helps investors focus on a company’s true value rather than short-term price fluctuations. It is ideal for long-term investors seeking stable and sustainable returns. - Identifies fundamentally strong but undervalued stocks

By analyzing key financial metrics like the P/E ratio, ROE, and cash flow, investors can identify companies trading below their intrinsic value. This method supports value-based investment decisions. - Helps assess macroeconomic and industry risks

Evaluating factors such as GDP growth, inflation rates, and sector trends provides insight into a company’s growth potential. This ensures investments align with broader economic and industry cycles.

Cons

- Requires significant time and effort

Investors must analyze financial statements, market trends, and company reports, which can be complex and time-consuming. Staying updated with economic news and company developments is essential but demanding. - Less effective for short-term trading

Since fundamental analysis focuses on long-term value, it is not well-suited for short-term traders. Short-term price movements are often driven by market sentiment, which fundamental analysis does not account for.

1.4 Example of Fundamental Analysis: ABC Inc.

To understand how fundamental analysis works in practice, let’s analyze a hypothetical company, ABC Inc., using key financial metrics.

Company Overview

ABC Inc. is a mid-sized technology firm with a growing market presence. Investors want to evaluate whether it is a good investment by examining its financial statements and ratios.

Key Financial Data

- Revenue: $1 billion

- Net Income: $150 million

- Stock Price: $25

- Earnings Per Share (EPS): $1.50

- Total Shareholder Equity: $1 billion

Step 1: Price-to-Earnings (P/E) Ratio

The P/E ratio helps investors determine if a stock is overvalued or undervalued by comparing the stock price to earnings per share (EPS).

A P/E ratio of 16.7 means investors are willing to pay $16.70 for every $1 of earnings. Comparing this to industry averages helps assess whether the stock is fairly valued.

Step 2: Return on Equity (ROE)

ROE measures how effectively the company generates profit from shareholder equity.

A 15% ROE indicates that ABC Inc. generates 15% profit for every dollar of shareholder investment, suggesting strong financial performance.

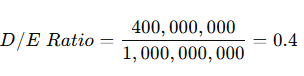

Step 3: Debt-to-Equity (D/E) Ratio

This ratio evaluates the company’s financial leverage by comparing total debt to shareholder equity.

If ABC Inc. has $400 million in debt:

A D/E ratio of 0.4 suggests a manageable debt level, indicating financial stability.

Conclusion

From this fundamental analysis, ABC Inc. appears financially strong with:

- A reasonable P/E ratio (16.7), suggesting fair valuation.

- A solid ROE (15%), showing efficient profit generation.

- A healthy D/E ratio (0.4), indicating low financial risk.

Investors looking for long-term growth may find ABC Inc. attractive based on these fundamentals. However, additional qualitative factors, industry trends, and macroeconomic conditions should also be considered before making an investment decision. additional qualitative factors, industry trends, and macroeconomic conditions should also be considered before making an investment decision.

2. Understanding Technical Analysis

2.1 What is Technical Analysis?

Technical analysis is a method of evaluating stocks based on historical price movements and trading volumes rather than a company’s intrinsic value. It assumes that all relevant information is already reflected in a stock’s price and that patterns tend to repeat over time due to market psychology.

Unlike fundamental analysis, which focuses on a company’s financial health, technical analysis is primarily used by short-term traders to identify potential entry and exit points. It relies on chart patterns, trend indicators, and volume data to predict future price movements.

At its core, technical analysis is built on three main assumptions:

- Market Prices Reflect All Information – The stock price already includes all publicly available data, so analyzing financial statements isn’t necessary.

- Price Movements Follow Trends – Stocks move in patterns that can be identified and used for predictions.

- History Tends to Repeat Itself – Market participants behave in repetitive ways, creating recognizable patterns over time.

2.2 Key Components of Technical Analysis

2.2.1 Price Charts

Price charts are the foundation of technical analysis, providing a visual representation of stock movements over time. The three most commonly used charts include:

- Candlestick Charts – The most popular type, displaying the opening, closing, high, and low prices for a given period. Candlesticks form patterns that indicate bullish or bearish trends.

- Line Charts – A simple representation that connects closing prices over time, useful for identifying general trends.

- Bar Charts – Similar to candlestick charts but without color coding, showing price fluctuations within a given timeframe.

Identifying Chart Patterns

Traders use historical price data to recognize chart patterns that signal future price movements. Some key patterns include:

- Head-and-Shoulders – A reversal pattern indicating a trend shift from bullish to bearish (or vice versa).

- Double Tops and Double Bottoms – Patterns that suggest a stock has reached a resistance or support level and may reverse direction.

- Moving Averages – Averages of past prices that smooth out fluctuations to help identify the stock’s overall trend. The two main types are:

- Simple Moving Average (SMA): Calculates the average closing price over a specific number of days.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new data.

By understanding price charts and recognizing these patterns, traders can make informed decisions about when to buy or sell a stock based on technical signals.

2.2.2 Technical Indicators

Technical indicators help traders interpret market trends, momentum, and potential reversals by analyzing historical price and volume data. Two widely used indicators are Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and helps traders determine whether a stock is overbought or oversold.

- RSI above 70: The stock is considered overbought, signaling a potential price decline.

- RSI below 30: The stock is considered oversold, suggesting a potential price rebound.

🔹 Example: If a stock’s RSI reaches 80, it may indicate an upcoming price correction as buying pressure slows down. Conversely, an RSI of 25 might suggest a buying opportunity as selling pressure eases.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following indicator that identifies changes in momentum and potential reversals by comparing two moving averages of a stock’s price:

- MACD Line: The difference between the 12-day and 26-day Exponential Moving Averages (EMA).

- Signal Line: A 9-day EMA of the MACD Line, used to generate buy/sell signals.

How it works:

- Bullish Signal: When the MACD Line crosses above the Signal Line, it suggests a buying opportunity.

- Bearish Signal: When the MACD Line crosses below the Signal Line, it signals a possible price decline.

🔹 Example: If a stock’s MACD crosses above the Signal Line after a period of downtrend, it could indicate a trend reversal and a good time to buy.

2.2.3 Volume Analysis

Volume analysis examines the number of shares traded over a given period. High trading volume typically confirms the strength of a price move, while low volume may indicate weak momentum or potential reversal.

- High Volume with Price Increase: Strong buying interest, confirming an uptrend.

- High Volume with Price Decline: Strong selling pressure, reinforcing a downtrend.

- Low Volume with Price Movement: Indicates weak conviction, making the trend unreliable.

🔹 Example: If a stock breaks out of a resistance level with high volume, it is more likely to sustain the upward momentum. However, if the breakout occurs on low volume, it may be a false signal, and the price could retreat.

By combining technical indicators like RSI and MACD with volume analysis, traders can make more informed decisions about market trends and price movements.

2.3 Pros and Cons of Technical Analysis

Pros:

- Ideal for Short-Term Traders and Timing Trades

Technical analysis is widely used by day traders and swing traders who seek to capitalize on short-term price movements. By analyzing historical trends and chart patterns, traders can make informed decisions on the best entry and exit points. - Uses Visual Tools to Simplify Decision-Making

Technical analysis relies on charts, indicators, and patterns that provide a clear, visual representation of stock price movements. This makes it easier for traders to quickly interpret data and react to market trends without needing to analyze complex financial reports. - Helps Understand Market Sentiment

By studying price trends, volume changes, and momentum indicators, technical analysis reflects the psychology of market participants. This allows traders to gauge whether a stock is experiencing bullish or bearish pressure, helping them anticipate potential movements.

Cons:

- Ignores the Actual Financial Health of a Company

Unlike fundamental analysis, technical analysis does not take into account a company’s earnings, revenue, or overall financial stability. This means that a stock’s price trend may look promising even if the underlying business is struggling. - Can Generate False Signals, Especially in Volatile Markets

Technical indicators and patterns are not foolproof. Sudden market fluctuations, unexpected news, or economic events can cause misleading signals, leading to poor trade decisions. Traders must be cautious and often use multiple indicators for confirmation.

3. Fundamental vs. Technical Analysis: Key Differences

| Aspect | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Focus | Intrinsic value, financial health, long-term trends | Price trends, short-term patterns |

| Data Used | Financial statements, economic reports | Historical price and volume data |

| Time Horizon | Long-term investing (years) | Short-term trading (days to weeks) |

| Tools | Financial ratios, qualitative assessments | Charts, indicators (RSI, MACD) |

| Best For | Value investors, long-term growth | Day traders, swing traders |

When analyzing a stock, fundamental and technical analysis serve different purposes and cater to different types of investors. Below is a detailed comparison of their key aspects:

1. Focus

- Fundamental Analysis: Determines a stock’s intrinsic value by evaluating the company’s financial health, management quality, and long-term growth potential.

- Technical Analysis: Focuses on price movements and market trends, identifying patterns that indicate short-term trading opportunities.

2. Data Used

- Fundamental Analysis: Relies on financial statements (income statement, balance sheet, and cash flow statement), macroeconomic indicators, and industry trends.

- Technical Analysis: Uses historical price and volume data, analyzing past movements to predict future trends.

3. Time Horizon

- Fundamental Analysis: Ideal for long-term investors who hold stocks for years based on intrinsic value and future earnings potential.

- Technical Analysis: Best suited for short-term traders who capitalize on price fluctuations over days or weeks.

4. Tools

- Fundamental Analysis: Uses financial ratios (P/E, ROE, D/E) and qualitative assessments like management evaluation and competitive advantage.

- Technical Analysis: Utilizes charts (candlestick, line, bar) and indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and trendlines.

5. Best For

- Fundamental Analysis: Favored by value investors looking for companies with strong fundamentals and long-term growth potential.

- Technical Analysis: Preferred by day traders and swing traders who rely on market patterns and momentum for quick profits.

While both approaches differ significantly, many investors use a hybrid strategy, combining fundamental analysis for stock selection and technical analysis for precise entry and exit points.

4. Combining Fundamental and Technical Analysis

While fundamental and technical analysis are often seen as separate approaches, many successful investors combine both methods to enhance decision-making and maximize returns. This hybrid strategy ensures that an investment is fundamentally strong while also being timed effectively for optimal entry and exit points.

4.1 Fundamental Screening: Identifying Strong Stocks

The first step in this approach is to use fundamental analysis to filter out fundamentally weak stocks and identify companies with strong financial health. Investors look for:

- Undervalued Stocks: Stocks with a low Price-to-Earnings (P/E) ratio compared to industry peers.

- Healthy Financials: Companies with strong revenue growth, profitability (ROE), and manageable debt (D/E ratio).

- Industry Leaders: Businesses with a competitive advantage, strong brand presence, and effective management.

By focusing on these fundamental factors, investors can shortlist stocks that have long-term growth potential and are less likely to suffer from financial instability.

4.2 Technical Timing: Choosing the Right Entry and Exit Points

Once fundamentally strong stocks are identified, technical analysis helps investors determine when to buy or sell by analyzing price movements and trends. Key techniques include:

- Moving Averages: Identify potential buying opportunities when a stock crosses above its 50-day or 200-day moving average.

- Relative Strength Index (RSI): Buy when RSI is below 30 (oversold) and sell when it’s above 70 (overbought).

- Candlestick Patterns: Recognize trend reversals with bullish engulfing, head-and-shoulders, or double-bottom patterns.

By leveraging these tools, investors can avoid buying at overvalued levels and maximize profits by selling at strong resistance points.

4.3 The Power of a Hybrid Approach

The combination of fundamental and technical analysis provides a balanced investment strategy that reduces risks and enhances returns:

- Fundamental analysis ensures long-term sustainability by selecting financially sound companies.

- Technical analysis optimizes trade execution by finding ideal buying and selling moments.

This hybrid approach is especially useful for swing traders, position traders, and long-term investors who want the best of both worlds—strong stocks with well-timed trades.

Conclusion

Analyzing a stock before investing is essential to making informed financial decisions and minimizing risk. Both fundamental analysis and technical analysis provide valuable insights, but they serve different purposes. Fundamental analysis helps investors understand a company’s intrinsic value, financial health, and long-term growth potential, making it ideal for long-term investors. On the other hand, technical analysis focuses on price movements and market trends, making it useful for traders looking to capitalize on short-term opportunities.

Rather than choosing one approach over the other, investors can benefit from a hybrid strategy—using fundamental analysis to identify strong stocks and technical analysis to time their entry and exit points. By integrating both methods, investors can make well-rounded, data-driven decisions that align with their financial goals and risk tolerance.

One Response