Intraday trading vs. long-term investing: Which is better?

Introduction

Are you looking to grow your wealth quickly, or do you prefer slow, steady gains over time? The way you approach investing can significantly impact your financial journey, but with so many strategies available, it can be difficult to decide which one is right for you.

Alt Tag: Focused intraday trader analyzing stock charts with technical indicators in a fast-paced office environment.

When it comes to growing wealth through the stock market, two of the most popular strategies are intraday trading and long-term investing. Each approach has its own distinct advantages and challenges, and they cater to different types of investors. Intraday trading focuses on short-term price movements, requiring active engagement and quick decision-making. In contrast, long-term investing is about holding assets over years or even decades, with an emphasis on long-term growth and compounding.

In this blog, we will dive deep into both intraday trading and long-term investing, exploring the benefits and drawbacks of each strategy. By the end, you will have a clearer understanding of which approach aligns best with your financial goals, risk tolerance, and lifestyle. Whether you’re aiming for fast profits or steady wealth accumulation, the right strategy is out there for you.

What is Intraday Trading?

Intraday trading refers to the practice of buying and selling financial instruments, such as stocks, within the same trading day. Unlike long-term investing, where assets are held for months or years, intraday trading focuses on capitalizing on small, short-term price movements. The goal is to profit from the fluctuations in a stock’s price during the day, with trades often executed multiple times within a single session.

To succeed in intraday trading, traders rely heavily on technical analysis, a method that uses past market data, price charts, and various indicators to predict future price movements. By analyzing patterns, trends, and momentum, traders can make quick decisions on when to enter or exit a trade. Intraday traders must have a deep understanding of market dynamics and a keen eye for spotting opportunities in real-time.

How it Works:

Here’s how the day-to-day of intraday trading typically goes:

- Setting Up Your Trading Account:

First, you’ll need to open a trading account. It’s the place where you can buy and sell your stocks. You also need a linked demat account to store your stocks electronically. Pretty standard stuff. - Doing the Homework:

Before making any moves, traders put a lot of time into research. They’ll study stock charts and look at trends, using tools to help predict how a stock might perform. A lot of this is about spotting patterns—whether that’s a stock consistently rising or dropping throughout the day. Common tools like Moving Averages or the Relative Strength Index (RSI) are used to help predict where the stock price might go next. - Making the Trade:

Once they’ve done their homework, it’s go-time. If they spot an opportunity, they buy the stock, with plans to sell it before the day’s end. They’re looking to take advantage of even small price changes. Timing is everything here. - Using Margin and Leverage:

Some traders use margin trading, which is when they borrow money from their broker to make bigger trades. This is called leverage, and while it can amplify profits, it also means there’s more risk. If the stock moves in the wrong direction, the losses can be more significant. - Using Technical Indicators:

Intraday traders rely on tools and indicators to guide their decisions. Some of the key ones include:- Moving Averages: These smooth out price fluctuations and help spot trends.

- RSI (Relative Strength Index): This tells you whether a stock is overbought or oversold.

- Bollinger Bands: These help traders predict when a stock price might break out of a particular range.

- Volume Indicators: These help traders understand how strong a price move is.

By keeping an eye on these indicators, traders can make quick, data-driven decisions to try and maximize their profits for that day but also they have to consider more and more things like market mood and etc so for that you also have to be aware of what is going on in the market via news and current updates.

Advantages of Intraday Trading

Quick Profits:

One of the biggest draws of intraday trading is the potential for quick profits. Since intraday traders are looking to capitalize on small price movements within a single day, they can make multiple trades that, combined, lead to significant gains. Even though the individual price changes might be small, skilled traders can accumulate profits by executing well-timed trades throughout the day. This fast-paced approach means you can see results (both gains and losses) quickly—no waiting years to see the outcome like you might with long-term investing.

No Overnight Risk:

Another advantage of intraday trading is the no overnight risk factor. In traditional investing, you’re exposed to the market’s ups and downs overnight, which can be particularly nerve-wracking when big news or global events hit while the market is closed. Intraday traders, on the other hand, make sure all their positions are closed by the end of the day, so they don’t have to worry about any surprises when the market opens the next morning. In volatile markets, this ability to avoid overnight exposure can be a huge benefit, keeping your capital safer from unpredictable after-hours shifts.

Leverage Opportunities:

Intraday traders also have the advantage of leverage opportunities. Brokers often allow traders to borrow money to trade larger positions than they could afford with just their own capital. This is called margin trading and it can lead to larger profits if a trade goes well. For example, if a trader is able to leverage their position 10 times, a small percentage gain in the stock price could result in a much larger profit. However, it’s important to note that while leverage can amplify profits, it also increases the risk, as losses can be just as magnified.

Frequent Trading Opportunities:

Lastly, intraday trading offers frequent trading opportunities. The market moves constantly throughout the day, creating numerous chances to make profitable trades. Whether it’s capitalizing on news releases, stock price fluctuations, or technical patterns, there’s always something happening. For traders who love action, this is a major plus, as it gives them the chance to trade multiple times a day—each of which could lead to potential profits. If you’re someone who thrives in a fast-paced environment and enjoys making quick decisions, intraday trading offers a never-ending stream of opportunities.

But remember there is also a second side of the market that was very dangerous.

Disadvantages of Intraday Trading

Alt Tag: Stressed intraday trader overwhelmed by volatile stock market fluctuations on multiple monitors.

High Risk:

Intraday trading is often regarded as a high-risk strategy due to the rapid and unpredictable price fluctuations that occur throughout the day. Unlike long-term investing, where investments have time to weather market ups and downs, intraday traders rely on small price movements that can shift in a split second. This volatility creates a higher chance of losses, especially for those without a solid understanding of market dynamics or the necessary risk management strategies. Even experienced traders can be caught off guard by unexpected market shifts, making intraday trading a risky endeavor, particularly for those not prepared to handle such intense volatility.

Stressful Lifestyle:

The fast-paced nature of intraday trading can also lead to a stressful lifestyle. Traders need to constantly monitor the market, watch for patterns, and react swiftly to price changes. For those juggling multiple trades, the pressure to make the right decisions in real-time can be overwhelming. The need for intense focus and decision-making throughout the day often results in mental fatigue, leading to stress and burnout over time. This makes intraday trading not only a financial challenge but also a psychological one, requiring traders to be both emotionally resilient and highly disciplined.

High Transaction Costs:

Frequent trading in intraday strategies also leads to high transaction costs. Every trade comes with associated brokerage fees, taxes, and commissions, which can quickly add up when trading multiple times a day. Even if each trade brings in modest gains, these costs can erode profits and, in some cases, lead to a net loss for traders. This is especially true for beginners who might not have honed their skills yet. The constant churn of trades means that, unless you’re consistently making profitable moves, transaction costs can become a significant barrier to success.

Limited Time for Analysis:

Lastly, one of the key drawbacks of intraday trading is the limited time for analysis. In the world of intraday trading, every minute counts. Traders rely heavily on technical analysis, using charts and indicators to predict short-term price movements. However, the fast-paced environment often leaves little room for deep research or thorough analysis. As a result, many trades are based on impulse rather than well-informed decisions, leading to potential errors or missed opportunities. This makes it harder to adopt a thoughtful, calculated approach and increases the chances of reacting hastily to market conditions.

What is Long-Term Investing?

Long-term investing is the practice of holding assets—such as stocks, bonds, or real estate—for extended periods, typically ranging from several years to decades. The goal is to benefit from the long-term growth of the economy and individual businesses. Unlike short-term trading, where profits are realized in a matter of days or months, long-term investors focus on the bigger picture, betting on the gradual appreciation of their investments over time. This strategy is grounded in the belief that, despite short-term market fluctuations, the value of well-chosen assets will increase significantly over the years due to overall economic growth and the solid performance of businesses.

Alt Tag: Focused intraday trader analyzing stock charts with technical indicators in a fast-paced office environment.

How it Works:

At the core of long-term investing is the buy-and-hold strategy. Investors select assets they believe will appreciate over time, then hold onto them for years or even decades. This method requires patience, discipline, and confidence that the asset will increase in value over the long run. Instead of reacting to daily market movements, long-term investors are more focused on the fundamental health of the companies they invest in, as well as broader economic trends. They conduct in-depth fundamental analysis, assessing a company’s financial health, business model, management, and growth potential. By investing in companies that show strong fundamentals and align with long-term market trends (like technological advancements or shifts in consumer behavior), investors aim to realize substantial returns over time.

For instance, many long-term investors look at blue-chip stocks or index funds that track overall market growth. These investments tend to be less volatile, offering a more predictable growth trajectory, especially when held for many years. Unlike intraday trading, where timing is critical, long-term investing allows investors to weather market dips and focus on the long-term potential of their portfolios.

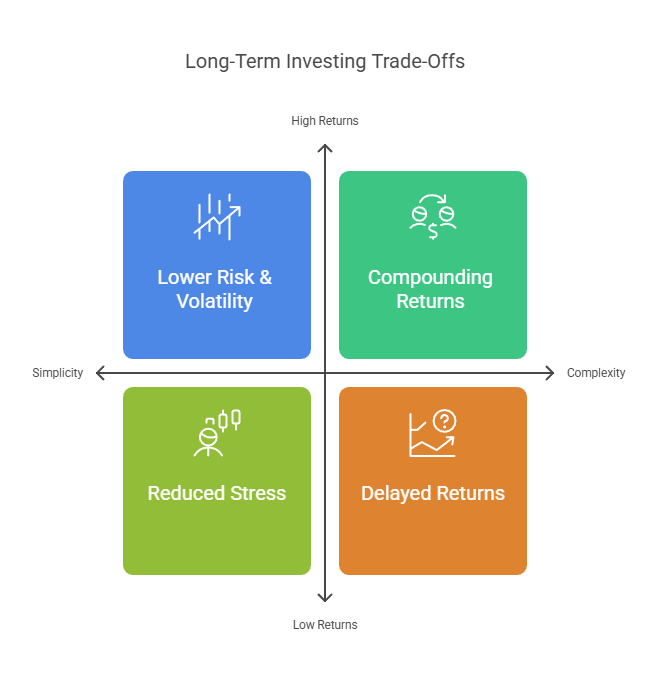

Advantages of Long-Term Investing

Lower Risk & Volatility:

One of the most significant advantages of long-term investing is its ability to reduce risk and volatility. Over time, the natural fluctuations in the market tend to even out. While short-term market movements can be erratic and unpredictable, long-term investors can afford to ride out the ups and downs. This is especially true when investing in well-established companies or broad market indices, which typically show more stability and consistent growth over the years. The longer you hold an investment, the more time you have for it to recover from downturns and for the market to smooth out short-term volatility.

Compounding Returns:

Long-term investing also benefits from the power of compounding returns. As investors hold assets over time, any dividends, interest, or capital gains earned on those investments can be reinvested to generate additional earnings. This creates a snowball effect, where the returns earned grow exponentially, building wealth in a way that short-term strategies like intraday trading simply can’t match. For example, reinvesting dividends in stocks can lead to even more shares, which, in turn, can generate more dividends. Over time, this compounding effect can significantly amplify the investor’s returns.

Reduced Stress:

Another key advantage of long-term investing is the lower stress involved compared to intraday trading. Long-term investors don’t need to monitor the markets constantly, allowing them to avoid the anxiety that comes with the fast-paced environment of intraday trading. Investors can set their strategies and then focus on other aspects of life, knowing that they’re building wealth steadily and without the need for constant, high-stakes decision-making. This makes long-term investing an ideal option for individuals who prefer a more relaxed and less time-intensive approach to growing their wealth.

Simplicity:

Long-term investing is often much simpler than intraday trading. There’s no need to track minute-by-minute market movements, analyze daily trends, or make frequent decisions based on short-term market noise. Instead, investors can focus on making strategic investments in high-potential assets and hold them over time. This simplicity allows individuals to spend less time managing their portfolios, making long-term investing an excellent choice for people with busy schedules or those who prefer a more hands-off approach.

Disadvantages of Long-Term Investing

Delayed Returns:

One of the main drawbacks of long-term investing is the delayed returns. Unlike intraday trading, where traders can potentially profit from price movements within a single day, long-term investing requires patience. It can take years or even decades for investments to fully realize their potential. Investors may have to wait for economic growth or company performance to drive up stock prices, meaning there may be little to no immediate gains, especially in the early stages of the investment. This slower pace of return can be frustrating for those looking for faster results or more active involvement in their investment portfolios.

Liquidity Constraints:

Another disadvantage of long-term investing is the liquidity constraints it imposes. Since long-term investments are typically held for extended periods, investors may find it challenging to access their capital in case of emergencies or urgent financial needs. Unlike short-term investments or more liquid assets, long-term stocks, bonds, or real estate properties often require time to sell or may incur penalties if sold before maturity. This lack of flexibility can be problematic for investors who need quick access to their funds.

Market Risks:

Although long-term investing generally smooths out volatility, it is not immune to market risks. Even though holding assets over time reduces the impact of short-term fluctuations, long-term investments can still be affected by broader economic downturns, recessions, or unforeseen events that disrupt markets. For example, a major financial crisis or a drastic economic shift can lead to prolonged declines in asset values, impacting returns. Despite the lower volatility over time, the risk of losing value remains, especially in uncertain or tumultuous market conditions.

Intraday Trading vs. Long-Term Investing: How to Choose?

Risk Tolerance:

The choice between intraday trading and long-term investing often comes down to risk tolerance. Intraday trading is inherently higher-risk due to the rapid price fluctuations that can occur throughout the day. This strategy is better suited for individuals with a high-risk appetite who are comfortable with the potential for quick losses, as well as quick gains. On the other hand, long-term investing is designed for those who prefer stability and a more conservative approach. It is ideal for investors with a low-to-moderate risk tolerance who are willing to weather short-term market volatility in exchange for potentially steady returns over the long run. Therefore, your risk tolerance plays a major role in determining which strategy aligns best with your investment goals.

Time Commitment:

Time commitment is another crucial factor when deciding between intraday trading and long-term investing. Intraday trading demands constant monitoring of the markets. Traders need to stay updated throughout the day, watching price movements, news, and market signals to make quick decisions. This makes intraday trading a time-intensive activity, often requiring a full-time commitment. Conversely, long-term investing allows for a more passive approach. Once you’ve selected your investments, they require far less attention. Investors in long-term assets typically monitor their portfolios on a quarterly or annual basis, making this strategy ideal for individuals who don’t have the time or inclination to manage their investments daily.

Financial Goals:

When it comes to achieving your financial goals, the right choice depends on your time horizon and objectives. If you’re looking for short-term profits to meet urgent financial needs, intraday trading might be the way to go. This approach can generate profits quickly, provided you have the right knowledge and strategy. However, if your goal is to accumulate wealth over time or plan for retirement, long-term investing is generally a better fit. Long-term investments provide the potential for compounding growth, helping you build a solid foundation for future financial security. By choosing stocks with strong growth potential and allowing them to appreciate over time, you can achieve greater financial stability and long-term returns.

Lifestyle and Preferences:

Lastly, your lifestyle and preferences play a significant role in determining which investment strategy suits you best. Intraday trading requires a high level of involvement, making it a good option for individuals who can dedicate significant time to analyzing and trading stocks throughout the day. This suits full-time traders or those with flexible schedules who are comfortable with the fast-paced nature of trading. In contrast, long-term investing is a lower-maintenance strategy, perfect for individuals who prefer a more hands-off approach to investing. It fits well with those who have a busy lifestyle or prefer not to spend excessive time managing their portfolio. Long-term investing can be a great choice for part-time investors who are looking to build wealth gradually without daily trading responsibilities.

Ultimately, the decision between intraday trading and long-term investing depends on your personal risk tolerance, time availability, financial goals, and lifestyle. By understanding your preferences and objectives, you can choose the strategy that best aligns with your needs.

Can You Combine Both Strategies?

Diversification:

Yes, it is absolutely possible—and often beneficial—to combine intraday trading and long-term investing into a single portfolio. This hybrid approach allows investors to take advantage of the strengths of both strategies, ultimately helping to mitigate risk while optimizing potential returns. By blending these two methods, investors can balance short-term volatility with the stability of long-term growth.

For example, an investor might allocate a portion of their portfolio to intraday trading in order to capitalize on short-term price movements and generate immediate returns. At the same time, they can hold a larger portion of their funds in long-term investments to benefit from compounding returns and consistent growth over time. This strategy allows for flexibility in managing different market conditions while ensuring the investor’s overall financial goals are met.

Combining intraday trading with long-term investing also helps smooth out the ups and downs of the market. The short-term risks of intraday trading can be balanced by the steadiness of long-term investments, resulting in a more diversified and resilient portfolio.

Examples of Hybrid Strategies:

Several successful investors and traders have demonstrated the value of combining both intraday trading and long-term investing. For example:

- Warren Buffett is often known for his long-term investing approach, but he also embraces short-term opportunities within his broader strategy. While his main focus is on buying undervalued companies for the long haul, he occasionally makes short-term moves based on market conditions or undervalued opportunities.

- Paul Tudor Jones, a well-known hedge fund manager, blends short-term trading with long-term investments. He combines technical analysis (used for intraday trading) with fundamental analysis (used for long-term investing) to manage risk and optimize returns. By doing this, Jones is able to generate profits quickly while also benefiting from the sustained growth of well-researched investments.

By utilizing a combination of both strategies, investors can optimize returns, diversify their portfolios, and manage risk more effectively. This hybrid approach requires careful planning and research, but when executed well, it can provide the best of both worlds: the potential for quick profits and long-term wealth growth.

Conclusion

In this blog, we’ve explored the key differences between intraday trading and long-term investing, highlighting the advantages and disadvantages of each approach. Intraday trading offers the potential for quick profits, leveraging short-term price movements, but comes with high risks, stress, and the need for constant attention. On the other hand, long-term investing provides lower volatility, compounding returns, and a more passive approach, but can result in delayed returns and liquidity constraints.

Both strategies have their merits, depending on your financial goals, risk tolerance, and time commitment. Choosing between them—or even combining both—depends on aligning these factors with your personal financial profile.

Final Thoughts from VegaMark:

When deciding between intraday trading and long-term investing, it’s essential to take a step back and evaluate your financial objectives. Are you looking to build wealth gradually over time, or are you seeking more immediate returns? Do you have the time and appetite for the fast-paced world of intraday trading, or would you prefer the steadiness of a long-term investment strategy?

Take time to reflect on your risk tolerance, time commitment, and overall financial goals to determine which strategy works best for you. Remember, there’s no one-size-fits-all approach, and many successful investors combine both strategies for a diversified portfolio.

We’d love to hear from you! What’s your preferred strategy: intraday trading or long-term investing? Share your thoughts or personal experiences in the comments below.

Additionally, for those looking to dive deeper into these strategies, be sure to check out our related resources:

- What is the stock market, and how does it work?

- How to start investing in the Indian stock market (Step-by-step guide)

FAQs

Is Intraday Trading Safe?

Intraday trading comes with significant risks due to the volatility of short-term market movements. While it offers the potential for quick profits, it can also result in substantial losses, especially for those who are not well-versed in market analysis. It’s important to approach intraday trading with caution and only trade with money you can afford to lose.

Can I make money from Long-Term Investing?

Yes, long-term investing can be a reliable way to build wealth over time. By investing in assets with strong growth potential, you benefit from the compounding of returns. The key to successful long-term investing is patience and a focus on companies with solid fundamentals. Over time, your returns can grow exponentially, as market trends and reinvested earnings accumulate.

What is the difference between intraday trading and long-term investing?

Intraday trading involves buying and selling financial instruments within the same day, focusing on short-term price movements. Long-term investing, on the other hand, involves holding assets for several years or even decades to benefit from long-term growth and compounding returns.

Is intraday trading a high-risk strategy?

Yes, intraday trading is generally considered high-risk due to the rapid and unpredictable price fluctuations during the day. Traders need to be skilled at technical analysis and risk management to minimize potential losses.

Can long-term investing help reduce market volatility risk?

Yes, long-term investing tends to reduce risk and volatility over time. By holding investments for longer periods, investors can ride out short-term market fluctuations and benefit from the gradual growth of their investments.

How much time does intraday trading require?

Intraday trading is very time-intensive, as traders must continuously monitor the market, study trends, and make quick decisions throughout the day. It is more suited to individuals who can dedicate significant time to trading.

Is it possible to combine intraday trading and long-term investing?

Yes, combining both strategies can be beneficial. A hybrid approach allows investors to take advantage of short-term profits through intraday trading while also benefiting from the steady growth and compounding returns of long-term investing.

2 Responses