1. Introduction

Intraday trading in India is a fast-paced, high-energy game where traders buy and sell stocks within the same day, aiming to cash in on quick price movements. With the right strategy, traders can turn small price fluctuations into steady profits—but success hinges on precision, speed, and, most importantly, minimizing costs.

Why Low Brokerage Fees Matter

Every trade comes with a cost, and for intraday traders making multiple trades a day, brokerage fees can add up fast! High charges can eat into profits, making it essential to choose a broker with ultra-low fees. The lower your costs, the higher your potential take-home gains. In a game where every rupee counts, a cost-effective broker can make all the difference between winning and losing.

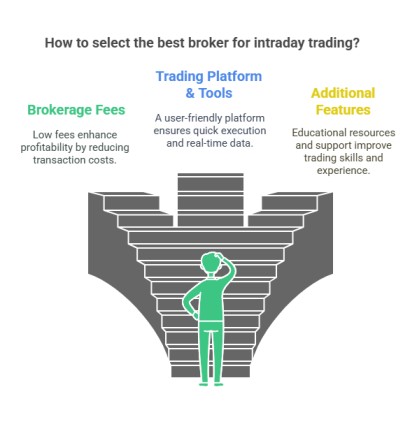

Key Factors to Consider When Choosing a Broker

To dominate the intraday market, you need a broker that offers:

Low Brokerage Fees – Keep more of your profits by choosing a broker with minimal charges.

Lightning-Fast Execution – A robust trading platform that executes orders instantly, without lag.

Powerful Trading Tools – Advanced charting, indicators, and analytics to help you make smart, data-driven decisions.

Seamless User Experience – A smooth, easy-to-navigate interface with top-notch customer support.

Picking the right broker isn’t just about saving money—it’s about maximizing profits, trading with confidence, and staying ahead in the fast-moving world of intraday trading. Choose wisely, trade smart, and let the markets work in your favor!

2. Criteria for Selecting the Best Brokers

Choosing the right broker for intraday trading is essential for maximizing profitability and ensuring a seamless trading experience. The best brokers offer a balance of affordability, technology, and trader-friendly features. Here are the key factors to consider:

1. Brokerage Fees: Impact on Profitability

Intraday trading involves frequent transactions, making brokerage fees a crucial factor. High brokerage charges can reduce overall profits, so selecting a broker with low fees is essential.

- Flat fees per trade are preferable over percentage-based fees for cost efficiency.

- Some brokers offer zero brokerage on equity delivery trades.

- Monthly or unlimited trading plans can be beneficial for high-volume traders.

2. Trading Platform & Tools: Importance of a User-Friendly Interface

A fast and efficient trading platform is critical for intraday traders who need real-time data and quick execution.

- A reliable platform ensures minimal delays and prevents price slippage.

- Advanced charting tools with multiple indicators help in technical analysis.

- A smooth and intuitive user interface enhances the trading experience.

- API access is beneficial for traders using automated strategies.

3. Additional Features: Enhancing the Trading Experience

Beyond low fees and a robust platform, additional features can improve a trader’s efficiency and decision-making.

- Educational resources help traders develop their skills and stay updated with market trends.

- Responsive customer support ensures quick issue resolution.

- Trading insights and recommendations provide valuable market analysis, especially for beginners.

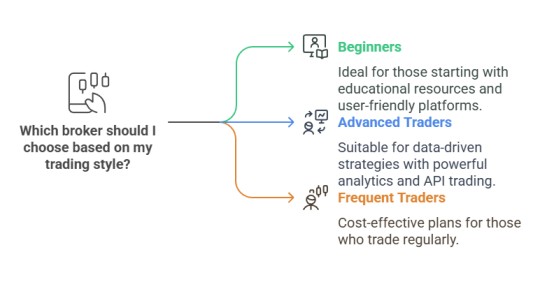

4. Suitability for Different Trader Types

Different traders have varying needs, and the ideal broker should align with their trading style.

- Beginners should prioritize easy-to-use platforms, educational resources, and guided trading support. Brokers like Angel One and Zerodha provide these features.

- Experienced traders require low fees, fast execution, and advanced analytical tools. Brokers like Upstox and Fyers offer strong technical support for active traders.

Selecting a broker that meets these criteria ensures a cost-effective and efficient trading experience. A well-informed choice can lead to better trade execution and higher profitability.

3. Top Brokers for Intraday Trading in India

Selecting the right broker is crucial for intraday traders, as it impacts both cost and efficiency. Here’s a detailed look at some of the best brokers in India for intraday trading, starting with Zerodha.

3.1 Zerodha

- Brokerage Fee: ₹20 per order or 0.03% (whichever is lower).

Key Features:

- Kite Trading Platform: A user-friendly and efficient platform with real-time data and advanced charting tools.

- Free Equity Delivery Trades: No brokerage on delivery-based transactions.

- Educational Resources: Zerodha Varsity provides in-depth learning material on trading and investing.

Why Choose Zerodha?

Zerodha is an excellent choice for traders looking for a low-cost, high-tech trading experience. Its innovative platform, combined with transparent pricing and educational support, makes it a preferred option for both beginners and experienced traders.

3.2 Upstox

- Brokerage Fee: ₹20 per order or 0.1% (whichever is lower).

Key Features:

- Advanced Trading Platforms: Upstox Pro Web and Mobile offer real-time market data and intuitive interfaces.

- API Trading Support: Allows advanced traders to automate and customize their strategies.

Why Choose Upstox?

Upstox is ideal for traders who require a high-performance platform with advanced tools, making it a great choice for active and tech-savvy traders.

3.3 Angel One

- Brokerage Fee: ₹20 per order or 0.25% of the transaction value.

Key Features:

- Trading Recommendations & Tips: Provides expert market insights and investment guidance.

- Free Equity Delivery Trades: No brokerage on delivery-based transactions.

Why Choose Angel One?

Angel One is well-suited for beginners who prefer expert guidance along with a competitive brokerage model.

3.4 Fyers

- Brokerage Fee: ₹20 per executed order or 0.03%.

Key Features:

- Comprehensive Analytics and Trading Tools: Advanced charting and research features for informed decision-making.

- Free Equity Delivery Trades: Cost-effective trading options for investors.

Why Choose Fyers?

Fyers is the best option for traders who rely on data-driven strategies and detailed market analysis.

3.5 ProStocks

- Brokerage Fee: ₹15 per order; unlimited trading plan available at ₹899 per month.

Key Features:

- No Brokerage on Equity Delivery: Reduces overall trading costs.

- Real-time Charting & Multiple Order Types: Supports advanced trading strategies.

Why Choose ProStocks?

ProStocks is an excellent choice for high-frequency traders looking for an affordable, unlimited trading plan.

3.6 5paisa

- Brokerage Fee: ₹20 per order (₹10 per order in the premium plan).

Key Features:

- Transparent Pricing: No hidden charges, ensuring cost-effective trading.

- Wide Range of Investment Products: Offers options beyond equities, including mutual funds and insurance.

Why Choose 5paisa?

5paisa is suitable for traders looking for a simple, low-cost brokerage model with a broad investment portfolio.

4. Comparison Table of Brokers

Below is a summarized comparison of the top brokers for intraday trading in India, highlighting their brokerage fees, key features, and best use cases.

| Broker | Brokerage Fee | Key Features | Best For |

|---|---|---|---|

| Zerodha | ₹20 per order or 0.03% (whichever is lower) | Kite platform, free equity delivery, educational resources (Varsity) | Low-cost trading with advanced technology |

| Upstox | ₹20 per order or 0.1% (whichever is lower) | Upstox Pro Web & Mobile, API trading support | Traders needing advanced tools |

| Angel One | ₹20 per order or 0.25% of transaction value | Trading recommendations, free equity delivery | Beginners seeking expert insights |

| Fyers | ₹20 per executed order or 0.03% | Strong analytics, advanced trading tools, free equity delivery | Data-driven traders |

| ProStocks | ₹15 per order; ₹899/month for unlimited trades | No brokerage on delivery, real-time charting, multiple order types | Frequent traders looking for cost savings |

| 5paisa | ₹20 per order (₹10 per order in premium plan) | Transparent pricing, multiple investment products | Traders seeking a simple, low-cost model |

This comparison helps traders choose the most suitable broker based on their trading style, cost considerations, and platform requirements.

Read More : How do FII and DII investments impact the Indian stock market?

5. Conclusion

Selecting the best broker for intraday trading in India depends on individual trading needs, cost considerations, and platform features. While all the brokers listed offer competitive pricing and advanced tools, the right choice varies based on trading experience and strategy.

Recommended Brokers Based on Trader Type

- Beginners: Angel One and Zerodha provide educational resources and user-friendly platforms, making them ideal for those just starting.

- Advanced Traders: Upstox and Fyers offer powerful analytics, API trading, and advanced tools for traders who rely on data-driven strategies.

- Frequent Traders: ProStocks stands out with its unlimited trading plan, while 5paisa offers a low-cost premium plan for cost-conscious traders.

Final Thoughts

Choosing the right broker can significantly impact trading profitability. A low-cost structure, combined with a robust trading platform and essential features, ensures an efficient and profitable trading experience. Traders should evaluate their priorities—whether it’s affordability, technology, or market insights—before making a decision.

By selecting a broker that aligns with your trading style, you can maximize profits and enhance your overall intraday trading experience.