Stock investing is a cornerstone of a robust personal finance strategy. While saving money is important, investing is the engine that drives wealth creation. The primary reason most people turn to the stock market is to generate long-term returns that outperform traditional assets like Fixed Deposits or Gold.

However, the stock market can be intimidating for beginners. Before diving into trading strategies, you must understand the fundamentals. In this guide, we will break down what stocks are, the different types available in the Indian market, and how to evaluate them.

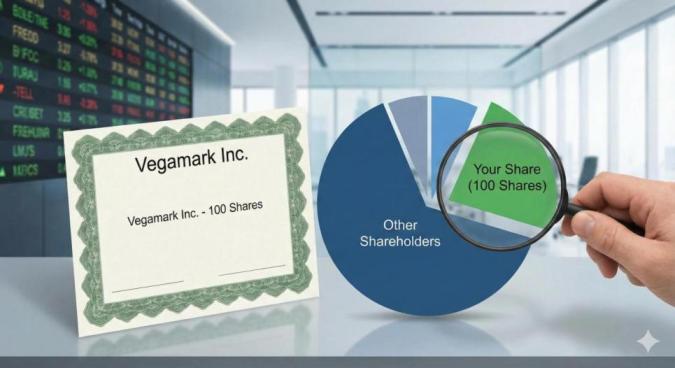

What is a Stock?

A Stock (or equity) represents a certificate of ownership in a company. When you purchase a stock, you are buying a small piece of that business.

- Stock: generally refers to the ownership certificates of any company.

- Share: refers to the stock certificate of a particular company.

What does owning a stock actually mean?

Owning a stock means you have a claim on the company’s assets and earnings. However, many new investors misunderstand their rights. As a shareholder, you generally benefit in two ways:

- Price Appreciation: The value of the stock goes up over time.

- Dividends: The company shares a portion of its profits with you.

Note: Not all stocks pay dividends, and stock prices can depreciate. This is why successful investors build diversified portfolios across different industries and geographies rather than concentrating all their capital in one place.

Stock vs. Shares: What’s the Difference?

People often use these words interchangeably, but there is a subtle difference:

- “I own shares” implies you own stock in a specific company (e.g., “I own shares of Tata Motors”).

- “I own stocks” implies you own equity in multiple different companies (e.g., “I own stocks in the tech and auto sectors”).

Types of Stocks: A Detailed Classification

Not all stocks are created equal. To build a balanced portfolio, you must understand the different categories of stocks available in the market.

1. Based on Ownership (Voting Rights)

- Common Stocks: These are the shares most people buy. They come with voting rights, allowing you to vote on corporate policies and board members. However, in the event of liquidation (bankruptcy), common shareholders are paid last.

- Preferred Stocks: These shareholders usually do not have voting rights. However, they have a higher claim on assets and earnings. They receive dividend payments before common shareholders, and these dividends are often fixed.

- Hybrid Stocks: Some companies issue preferred shares with an option to convert them into common shares after a specific period.

- Stocks with Embedded Derivatives: These are rare but include features like “Callable” or “Putable” options, allowing the company or the holder to buy/sell the stock back at a specific price point.

2. Based on Market Capitalization

Market Capitalization (Market Cap) is the total value of a company’s outstanding shares. It is calculated as:

- Large-Cap Stocks: These are well-established “Blue-chip” companies with a strong track record. While they may not offer explosive growth, they are generally stable and often pay regular dividends. They are considered lower risk.

- Mid-Cap Stocks: Usually defined as companies with a market cap between ₹5,000 Cr and ₹20,000 Cr. These are riskier than large-caps but offer higher growth potential. Many of today’s mid-caps are tomorrow’s large-caps.

- Small-Cap Stocks: Companies with a market cap below ₹5,000 Cr. These are often young companies with massive growth potential but come with high volatility. They are suitable for aggressive investors willing to hold for the long term.

3. Based on Dividend Payment

- Income Stocks: These stocks pay high, regular dividends relative to their share price. They are usually mature, stable companies (like utilities or FMCG) that generate steady cash flow but have slower growth.

- Growth Stocks: These companies rarely pay high dividends. Instead, they reinvest their profits to expand the business. Investors buy these stocks for capital appreciation (stock price increase) rather than passive income.

4. Based on Market Trends & Risk

- Defensive Stocks: These stocks belong to industries that remain stable regardless of the economy (e.g., Healthcare, FMCG). People need medicine and food even during a recession, making these stocks “defensive” plays.

- Cyclical Stocks: These prices move in sync with the economy (e.g., Automobiles, Real Estate, Luxury goods). They boom when the economy is doing well and crash when the economy slows down.

- High Beta (Volatile) Stocks: “Beta” measures volatility. If a stock has a Beta > 1, it is more volatile than the market. High beta stocks offer high risk and high reward.

- Blue Chip Stocks: The safest bet. These are nationally recognized, well-established, and financially sound companies.

Why Invest in Stocks? (The Benefits)

- Beat Inflation: Stocks historically provide returns that outpace inflation, protecting your purchasing power.

- The Power of Compounding: Reinvesting returns over time leads to exponential growth.

- Ownership Stake: You become a partial owner of some of the world’s best businesses.

- Liquidity: Unlike real estate, stocks are easy to buy and sell quickly.

- Small Ticket Size: You can start investing with very small amounts (via SIPs or fractional shares).

The Risks You Must Know

While the potential for reward is high, the risks are real:

- Capital Loss: Stock prices can go to zero.

- Volatility: Emotional highs and lows caused by daily price fluctuations can lead to bad decisions.

- Last in Line: Common stockholders are the last to be paid if a company goes bankrupt.

How to Value a Stock?

Many beginners lose money because they buy stocks based on “hype” rather than value. To avoid this, you must look at Fundamentals.

1. Absolute Valuation

This method determines the “intrinsic” (true) value of a company by analyzing its dividends, cash flow, and growth rate. A common method is the Discounted Cash Flow (DCF) analysis.

2. Relative Valuation

This involves comparing a company to its competitors. Common ratios used here include:

- P/E Ratio (Price to Earnings): Is the stock expensive compared to its earnings?

- P/B Ratio (Price to Book): Is the stock trading below its asset value?

- Undervalued Shares: When the current price is lower than the intrinsic value (A buying opportunity).

- Overvalued Shares: When the current price is higher than the intrinsic value (A selling or avoidance signal).

Conclusion

Investing in the stock market is one of the most effective ways to build wealth, but it is not a “get rich quick” scheme. It requires patience, discipline, and an understanding of what you own.

By understanding the types of stocks—whether you prefer the stability of Large-Cap Blue Chips or the aggressive growth of Small-Caps—you can build a strategy that aligns with your financial goals.

(Also if you want to learn about history of Indian stock market click here .)

Frequently Asked Questions (FAQs)

Q1: What is the minimum amount required to start investing in the Indian stock market? A: There is no strict minimum limit. You can start investing with as little as ₹50 or ₹100, depending on the share price of the company you wish to buy. However, many experts suggest starting with a small, comfortable amount (like ₹500 or ₹1000) to understand how the market works before increasing your investment.

Q2: What is the difference between a Demat Account and a Trading Account? A: A Trading Account is used to buy and sell orders in the stock market. A Demat (Dematerialized) Account acts like a digital vault where your shares are stored safely in electronic format. You need both to invest in the Indian stock market.

Q3: How do beginner investors earn money from stocks? A: Beginners typically earn in two ways:

- Capital Appreciation: Selling the stock at a higher price than you bought it.

- Dividends: Receiving a share of the company’s profit, which is deposited directly into your bank account.

Q4: Which is better for beginners: Large-Cap or Small-Cap stocks? A: For beginners, Large-Cap stocks are generally recommended because they belong to established, stable companies and are less volatile. Small-Cap stocks offer higher growth potential but come with significantly higher risk, which requires more experience to manage.

Q5: Is stock market investing the same as gambling? A: No. Gambling relies purely on luck. Stock investing is based on Fundamental Analysis—studying a company’s business model, earnings, and growth potential. While short-term fluctuations can feel random, long-term investing is a strategic way to build wealth based on business performance.

Q6: What happens if a company I invested in goes bankrupt? A: As a common shareholder, you are the last to be paid during liquidation. If a company goes bankrupt, debt holders and preferred shareholders are paid first. This is why diversification (investing in multiple companies) is crucial to protect your capital.