What is a Company?

Section 2(20) of the Companies Act, 2013 defines a company as:

“A corporation organized in accordance with this Act or any preceding company law.”

In broader terms, a company is an incorporated association—an “artificial person”—created by law. It possesses a common seal, perpetual succession, and a separate legal identity from its members. It usually has a common capital comprised of transferable shares and offers limited liability to its owners.

Key Features of a Company

- Artificial Legal Person: A company is a legal entity created by law. It can own property, enter into contracts, sue, and be sued in its own name, just like a natural person.

- Separate Legal Entity: The company is distinct from its owners (shareholders) and managers (directors). The company alone is responsible for its debts and legal obligations; individual members are generally not personally liable for the company’s actions.

- Incorporated Association: A company comes into existence only after registration under the Companies Act. Recognition requires specific documentation (Memorandum of Association, Articles of Association) and compliance regarding directors and shareholders.

- Common Seal: As an artificial person, a company cannot sign documents. Instead, it uses a “Common Seal”—a stamp with the company’s name engraved on it—to act as its official signature. Documents bearing this seal are binding on the company.

- Limited Liability:

- Limited by Shares: A shareholder’s liability is limited to the unpaid value of the shares they hold.

- Limited by Guarantee: A member’s liability is limited to the amount they agreed to contribute to the company’s assets in the event of liquidation.

Classification of Companies

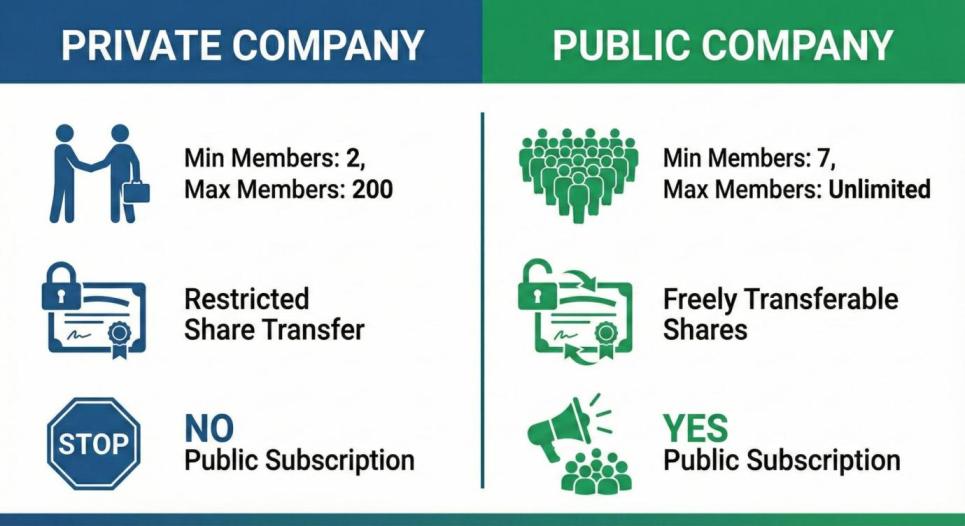

Here is the comparison table highlighting the key differences between a Private Company and a Public Company.

Comparison: Private Company vs. Public Company

| Criteria | Private Company | Public Company |

| Minimum Members | 2 | 7 |

| Maximum Members | 200 (excluding current/former employees) | Unlimited |

| Minimum Directors | 2 | 3 |

| Public Subscription | Strictly prohibited. Cannot invite the public to buy shares. | Allowed. Can invite the public to subscribe to shares. |

| Transfer of Shares | Restricted by the Articles of Association. | Freely transferable without restriction. |

| Prospectus | Not required to issue a prospectus. | Must issue a prospectus (or statement in lieu) before allotting shares. |

| Commencement of Business | Can start immediately after incorporation. | Requires a ‘Certificate of Commencement of Business’ after incorporation. |

| Name Suffix | Must end with “Private Limited” (Pvt. Ltd.). | Must end with “Limited” (Ltd.). |

| Quorum for Meetings | Minimum 2 members present personally. | 5 members (if <1000 total), 15 (if 1000-5000), 30 (if >5000). |

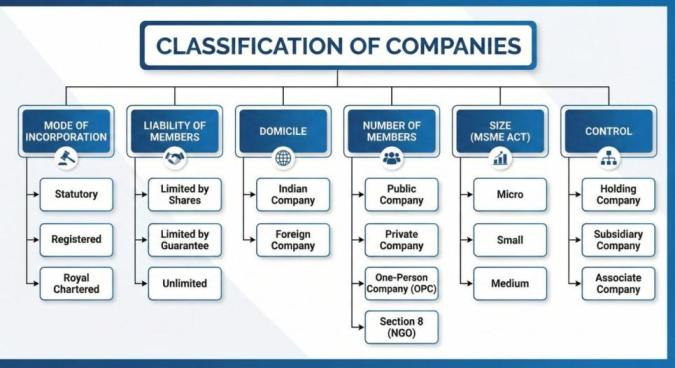

Companies can be divided into distinct categories based on specific criteria:

1. Based on Mode of Incorporation

- Statutory Companies: Created by a special act of the federal or state legislature to conduct critical national business.

- Example: The Reserve Bank of India (established under the RBI Act, 1934).

- Registered (Incorporated) Companies: Formed under the Companies Act. They come into existence only after the Registrar of Companies issues a Certificate of Incorporation.

- Royal Chartered Companies: Established by a special charter or command from a monarch.

- Examples: The East India Company, BBC, Bank of England.

2. Based on Liability of Members

- Companies Limited by Shares: The most common type. Liability is limited to the face value of shares subscribed by the member.

- Companies Limited by Guarantee: Liability is limited to a specific sum the member guaranteed to pay if the company is liquidated. These companies may or may not have share capital.

- Unlimited Companies: There is no cap on the liability of members. In the event of liquidation, members may be personally liable for the company’s debts without limit.

3. Based on Domicile

- Indian Company: A business incorporated and registered within India.

- Foreign Company: Defined under Section 2(42) of the Companies Act, 2013, as any company incorporated outside India that:

- Has a place of business in India (physically or electronically, directly or through an agent).

- Conducts business activity in India in any other manner.

4. Based on Number of Members

- Public Company: Defined in Section 2(71), a public company is one that is not a private company.

- Access: Shares are available to the general public and are freely transferable.

- Requirements: Minimum of 7 members and 3 directors. Must issue a prospectus (or file a statement in lieu of one) before allotting shares.

- Private Company: Defined in Section 2(68).

- Restrictions: Restricts share transfers and limits the number of members to 200. It cannot invite the public to subscribe to shares.

- Requirements: Minimum of 2 members and 2 directors.

- One-Person Company (OPC): Defined in Section 2(62).

- Structure: A private company with only one member (founder).

- Requirements: The founder must be a natural person and a resident of India. Specific turnover and capital thresholds apply (e.g., avg annual turnover limits) to maintain OPC status.

- Section 8 Company (NGO):

- Purpose: Formed for charitable objects like art, science, sports, environment, or social welfare.

- Rules: Profits must be applied toward these objects. Payment of dividends to members is prohibited.

5. Based on Size (MSME & Companies Act Definitions)

- Micro Company: Annual turnover does not exceed Rs. 5 crore, and investment in plant/machinery does not exceed Rs. 1 crore.

- Small Company:

- MSME Definition: Annual turnover does not exceed Rs. 50 crores, and investment in plant/machinery does not exceed Rs. 10 crores.

- Companies Act Definition (for exemptions): Paid-up share capital does not exceed Rs. 2 crores, and annual revenue does not exceed Rs. 20 crores.

- Medium Company: Annual revenue is less than Rs. 250 crores, and investment in equipment is less than Rs. 50 crores.

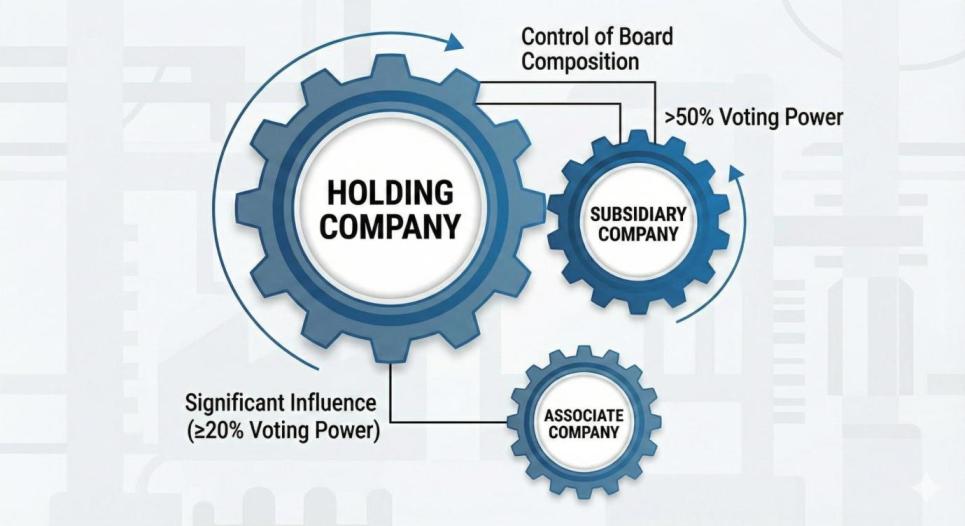

6. Based on Control

- Holding Company: A parent entity that controls the management, assets, and policies of another company (the subsidiary) by owning the majority of its voting shares.

- Subsidiary Company: A company controlled by another.

- If the holding company owns 100% of the voting power, it is called a Wholly Owned Subsidiary (WOS).

- Associate Company: A company in which another company has significant influence but not total control.

- Definition: “Significant influence” usually means controlling at least 20% of total voting power or participating in business decisions. This category includes Joint Ventures.

7. The Doctrine of “Lifting the Corporate Veil”

While a company is a separate legal entity distinct from its members, this protection is not absolute. In certain circumstances, the law allows the courts to look behind the “corporate veil” to identify the real individuals (directors or shareholders) responsible for the company’s actions. This is known as “Lifting of the Corporate Veil.”

When the veil is lifted, the company and its members are treated as one, and the members can be held personally liable for the company’s debts or illegal acts.

Common Grounds for Lifting the Veil:

- Fraud or Improper Conduct: If the company is formed merely to defeat the law, defraud creditors, or avoid legal obligations.

- Protection of Revenue: If a company is used solely for tax evasion or to hide illegal income.

- Statutory Provisions (Companies Act, 2013):

- Misstatement in Prospectus (Section 34 & 35): Directors/promoters are personally liable if they issue a prospectus with false information to mislead the public.

- Failure to Return Application Money (Section 39): If the company fails to repay application money within the specified time, the officers in default are personally liable.

- Fraudulent Trading (Section 339): During winding up, if it appears business was conducted to defraud creditors, the persons responsible are personally liable for the company’s debts.

8. Privileges and Exemptions of a Private Company

The Companies Act, 2013, grants several exemptions to Private Limited Companies to reduce their compliance burden and facilitate ease of doing business. This makes them the preferred choice for startups and small businesses.

Key Privileges Include:

- No Independent Directors: Private companies are not required to appoint Independent Directors (unlike Public companies which need at least one-third of the Board to be independent).

- Board Resolutions: They are exempted from filing certain Board resolutions (MGT-14) with the Registrar of Companies (RoC), keeping their internal decisions confidential.

- Quorum for Meetings: A quorum of only 2 members is sufficient for a General Meeting, whereas public companies require 5, 15, or 30 depending on member count.

- Loans to Directors: Restrictions on giving loans to directors (Section 185) are relaxed if specific conditions are met (e.g., no default on bank loans).

- Managerial Remuneration: There are no strict statutory limits on the salary paid to directors in a private company (Public companies have a cap of 11% of net profits).

9. Process of Formation (Incorporation)

Forming a company in India is now a centralized digital process. The Ministry of Corporate Affairs (MCA) uses the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) web form.

Brief Steps to Incorporation:

- Digital Signature Certificate (DSC): Directors must obtain a DSC to sign electronic documents.

- Director Identification Number (DIN): Applied for within the SPICe+ form itself.

- Name Reservation: Checking availability and reserving the company name (Part A of SPICe+).

- Drafting MoA and AoA:

- Memorandum of Association (MoA): Defines the company’s scope and objectives.

- Articles of Association (AoA): Defines internal rules and regulations.

- Filing SPICe+ Form: Submitting details of directors, subscribers, and registered office along with MoA/AoA.

- Certificate of Incorporation (CoI): Once approved, the RoC issues the CoI, which includes the Corporate Identity Number (CIN), PAN, and TAN.

Official Government Sources (India)

- Companies Act, 2013 (Full Text):India Code – The Companies Act, 2013

- Best for: Verifying Section numbers (e.g., Sec 2(68) for Private Company, Sec 8 for NGOs).

- MSME Definitions (Official Criteria):Ministry of MSME – Classification

- Best for: Confirming the specific Investment and Turnover limits for Micro, Small, and Medium enterprises.

- Company Incorporation (SPICe+):Ministry of Corporate Affairs – SPICe+ Forms

- Best for: Understanding the official digital forms used to register a company in India.

Conclusion

A company is a unique legal entity—a fictional, intangible person existing only in the eyes of the law. While it offers the benefit of pooling financial resources and limiting liability, it also comes with varying degrees of regulatory compliance.

From the solitary structure of a One-Person Company to the massive scale of Public Limited Companies, the classification depends heavily on the organization’s goals, size, and capital requirements. Whether it is a charitable Section 8 company or a commercial giant, understanding these classifications is essential for proper governance and legal compliance.