Introduction

Blue-chip stocks are shares in well-established, financially robust companies known for their consistent performance and long-term reliability. Often leaders in their industries, these stocks have built a strong reputation over decades by demonstrating stable earnings, paying regular dividends, and maintaining solid financial health. This dependable track record makes blue-chip stocks an attractive option for new investors seeking a secure entry into the market, as well as for seasoned investors who value steady, long-term returns even during economic fluctuations.

What Are Blue-Chip Stocks?

Blue-chip stocks refer to shares of well-established, financially sound companies with a long history of stability and reliable performance. These companies are typically industry leaders known for their ability to generate consistent profits, even during economic downturns.

Blue-chip stocks are closely associated with large-cap companies, which have a market capitalization of $10 billion or more. Their size and financial strength allow them to maintain steady growth, pay regular dividends, and withstand market volatility better than smaller or emerging companies.

In the stock market, blue-chip stocks play a crucial role in shaping major indices such as the NIFTY 50, Bank Nifty. Their inclusion in these benchmarks highlights their influence on overall market trends, making them a preferred choice for investors looking for stability, consistent returns, and long-term growth potential.

Read This Also : How to invest in mutual funds vs stocks – Which one is better?

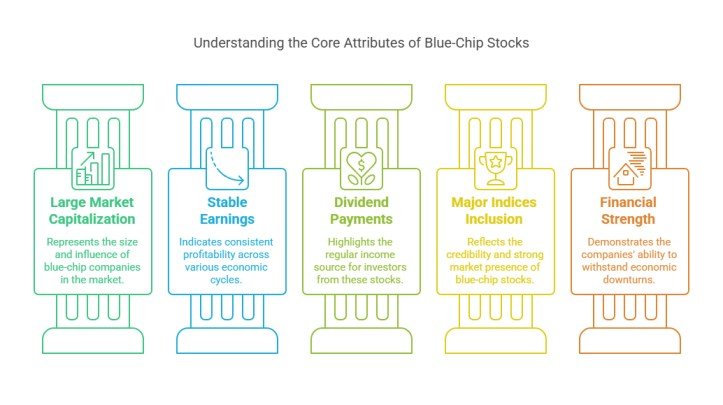

Key Characteristics of Blue-Chip Stocks

1. Large Market Capitalization

Blue-chip stocks belong to companies with a market capitalization of $10 billion or more, making them some of the largest players in the stock market. Their size and financial strength grant them significant influence within their respective industries, allowing them to shape market trends and withstand economic fluctuations.

2. Stable Earnings

These companies consistently generate profits across different economic cycles, demonstrating their ability to maintain steady financial performance. Their proven business models and strong revenue streams help foster investor confidence, making them a preferred choice for long-term investment.

3. Dividend Payments

Many blue-chip stocks pay regular dividends, offering investors a reliable source of income. Mature companies that have already achieved substantial growth often prioritize dividend payouts as a way to reward shareholders, making these stocks particularly attractive for income-focused investors.

4. Inclusion in Major Indices

Blue-chip stocks are typically listed in major stock market indices such as the S&P 500 or the Dow Jones Industrial Average. Being part of these indices signals credibility, as it reflects a company’s strong financial standing and stable market presence.

5. Financial Strength and Stability

These companies maintain strong balance sheets, low debt levels, and robust cash flows, ensuring their ability to navigate economic downturns. Their financial resilience allows them to continue operations, pay dividends, and invest in future growth even during challenging market conditions.

6. Global Presence

Many blue-chip companies operate internationally, generating revenue from multiple regions. This global footprint helps them mitigate risks associated with regional economic challenges and currency fluctuations, ensuring more stable and diversified earnings.

Why Should You Invest in Blue-Chip Stocks?

1. Safety and Security

One of the primary reasons investors choose blue-chip stocks is their stability, even during market downturns. These companies have weathered economic recessions, industry disruptions, and financial crises while maintaining their strong market presence. Their long track record of success demonstrates resilience, making them a reliable choice for investors looking to preserve capital and achieve steady growth over time.

2. Consistent Dividend Income

Many blue-chip stocks pay regular dividends, making them a reliable source of passive income for investors. These companies have a history of distributing profits to shareholders, providing steady returns even in volatile market conditions. This consistency appeals to long-term investors who seek financial stability and a dependable income stream, especially during economic downturns.

3. Growth Potential

Despite being well-established, many blue-chip companies continue to expand their operations, enter new markets, and innovate. This ongoing growth creates opportunities for capital appreciation alongside dividend income. Investors can benefit not only from stable earnings but also from the potential for their investments to increase in value over time.

4. Less Volatility

Compared to smaller or emerging companies, blue-chip stocks typically experience less price fluctuation. Their strong market presence, diversified revenue streams, and solid financial health contribute to reduced volatility, making them an ideal choice for risk-averse investors. This stability provides peace of mind, especially for those looking to build wealth over the long term.

5. High Liquidity

Blue-chip stocks are highly liquid due to their widespread popularity among both institutional and retail investors. This means they can be easily bought or sold on the stock market without significantly impacting their price. Their high trading volume ensures investors can enter or exit positions efficiently, adding to their appeal as a secure investment option.

Conclusion

Blue-chip stocks offer a compelling combination of stability, reliability, and growth potential, making them an excellent choice for investors of all experience levels. Their strong financial foundations, consistent dividend payouts, and resilience during market fluctuations provide a sense of security that few other investments can match.

For a well-balanced portfolio, blue-chip stocks serve as a cornerstone, reducing overall risk while still offering opportunities for steady returns. Whether you’re a new investor looking for a safe starting point or a seasoned trader aiming for long-term wealth preservation, these stocks can play a vital role in achieving financial stability.

By incorporating blue-chip stocks into your investment strategy, you can enjoy the benefits of lower volatility, passive income through dividends, and long-term capital appreciation—helping you build a strong financial future.