1. Introduction

Compounding in stock investing is a powerful financial concept that allows investments to grow exponentially over time. It works by reinvesting earnings—whether from capital gains or dividends—so that future returns are generated not just on the original investment but also on the accumulated gains. This “interest on interest” effect can significantly amplify wealth, making compounding one of the most effective strategies for long-term investing.

The true power of compounding lies in its ability to transform small, consistent investments into substantial wealth over extended periods. Investors who start early and remain disciplined in reinvesting their earnings can benefit from accelerated growth, even without making additional contributions.

In this blog, we will explore how compounding works in stock investing, breaking down its key components and real-world examples such as Dividend Reinvestment Plans (DRIPs), Long-Term Growth Investments, and Systematic Investment Plans (SIPs). These examples will help you understand why compounding is often referred to as the eighth wonder of the world by financial experts.

2. Understanding Compounding

At its core, compounding in investments refers to the process where returns generated from an investment are reinvested to earn additional returns over time. This creates a snowball effect, allowing an investment to grow at an accelerating rate rather than a fixed linear rate. The longer the investment remains untouched, the more substantial the growth becomes, making compounding a crucial strategy for wealth creation.

Simple Interest vs. Compound Interest

To fully grasp the power of compounding, it’s essential to distinguish it from simple interest:

- Simple Interest is calculated only on the initial investment (principal). For example, if you invest ₹10,000 at an annual interest rate of 10% for five years, you will earn ₹1,000 each year, totaling ₹5,000 in interest. The final amount after five years would be ₹15,000.

- Compound Interest, on the other hand, is calculated on both the principal and any accumulated interest. Using the same example of ₹10,000 at a 10% annual return, in the first year, you earn ₹1,000, making the total ₹11,000. In the second year, interest is now calculated on ₹11,000 instead of ₹10,000, earning ₹1,100, and so on. Over five years, this investment would grow to approximately ₹16,105—higher than the ₹15,000 earned through simple interest.

The Power of “Interest on Interest”

The magic of compounding lies in its exponential nature, often referred to as the “interest on interest” effect. As earnings are reinvested, each new cycle generates returns not only on the original investment but also on the accumulated earnings from previous cycles. This creates a multiplying effect, where the longer you let an investment grow, the faster it expands.

This phenomenon is why compounding is regarded as a fundamental principle of long-term investing. With enough time and consistency, even modest investments can grow into substantial wealth, proving that time in the market is far more valuable than timing the market.

Read More : How RBI interest rate changes affect the stock market?

3. Key Components of Compounding

Compounding works most effectively when certain key factors are optimized. One of the most critical elements is the reinvestment of earnings, which allows an investment to generate returns on both the initial capital and any accumulated gains.

3.1 Reinvestment of Earnings

Reinvesting earnings—whether in the form of dividends or capital gains—significantly enhances the compounding effect. Instead of withdrawing profits, investors can reinvest them to acquire more assets, which in turn generate additional earnings. This cycle repeats over time, creating exponential growth.

Dividend Reinvestment in Stocks

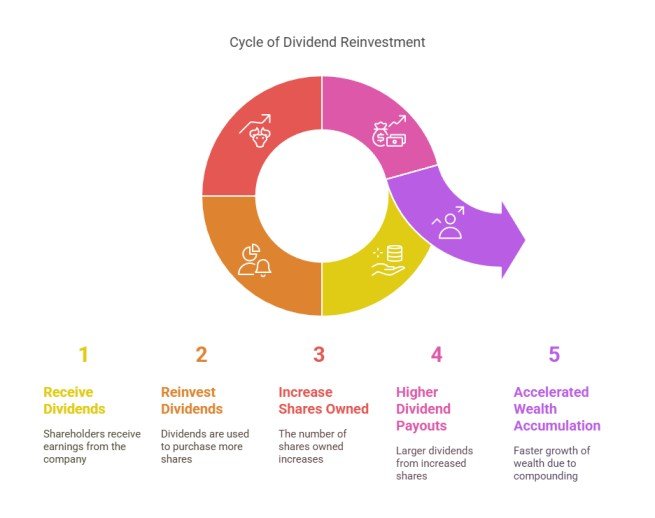

In stock market investing, dividend-paying companies distribute earnings to shareholders. Instead of cashing out these dividends, investors can participate in Dividend Reinvestment Plans (DRIPs), where dividends are automatically used to purchase more shares. This leads to:

- An increase in the number of shares owned.

- Higher dividend payouts in subsequent periods.

- A compounding effect that accelerates wealth accumulation.

For example, if an investor owns 100 shares of a company that pays a ₹10 dividend per share, they earn ₹1,000 in dividends. If they reinvest this amount to buy more shares instead of withdrawing it, their total share count increases. In the next dividend cycle, they receive payouts based on this higher share count, leading to even greater reinvestment potential.

Read More: How do FII and DII investments impact the Indian stock market?

Capital Gains Reinvestment

Beyond dividends, investors can also reinvest capital gains—profits earned from selling stocks at a higher price than their purchase price. Rather than withdrawing these gains, reinvesting them into new or existing high-growth investments maximizes the compounding impact.

By continuously reinvesting earnings, investors harness the full power of compounding, setting the stage for significant long-term financial growth.

3.2 Time Factor

Time is one of the most powerful elements in the process of compounding. The earlier an investor starts, the more time their investments have to grow exponentially. This is because compounding works like a snowball effect—the longer the investment remains untouched, the greater the accumulated earnings, which in turn generate additional returns.

Why Starting Early Matters

The impact of compounding increases significantly over extended investment periods. Even small investments made early can grow substantially compared to larger investments made later in life.

For instance, consider two investors:

- Investor A starts investing ₹5,000 per month at age 25 with an expected annual return of 12%.

- Investor B starts investing ₹10,000 per month at age 35 with the same 12% return.

By age 55, even though Investor B contributed twice as much, Investor A will still have a larger portfolio due to the extra 10 years of compounding. This demonstrates why time in the market is more important than timing the market.

Longer Investment Horizons Enhance Returns

With each passing year, the accumulated gains generate additional earnings. This effect becomes more pronounced over 20–30 years, where the power of compounding turns even moderate investments into substantial wealth.

3.3 Frequency of Compounding

Another crucial factor in compounding is how often interest is compounded. The more frequently an investment compounds, the faster it grows.

Understanding Compounding Frequencies

Compounding can occur on different schedules, such as:

- Annually (once a year)

- Semiannually (twice a year)

- Quarterly (four times a year)

- Monthly (twelve times a year)

- Daily (every day)

Each increase in frequency results in slightly higher total returns because earnings are reinvested more frequently.

Why More Frequent Compounding Leads to Higher Growth

If ₹1,00,000 is invested at an 8% annual interest rate, the ending value differs based on compounding frequency:

- Annually: ₹1,08,000

- Semiannually: ₹1,08,160

- Quarterly: ₹1,08,243

- Monthly: ₹1,08,300

- Daily: ₹1,08,327

Although the difference may seem small in the short term, over decades, frequent compounding can lead to substantially larger wealth accumulation.

For stock investors, this means that dividend reinvestments, mutual fund returns, and systematic investment plans (SIPs) benefit more from frequent compounding. Understanding and leveraging this principle can significantly boost long-term financial growth.

4 Real Examples of Compounding in Stock Investing

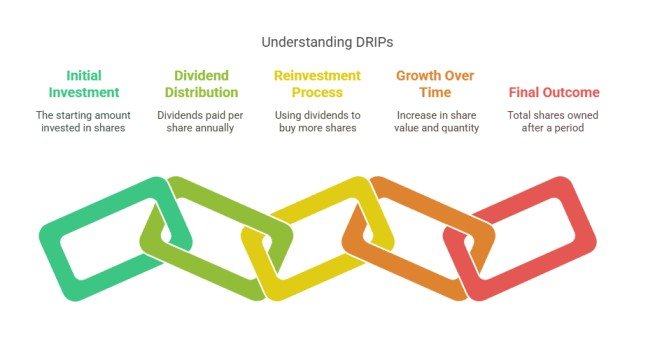

4.1 Dividend Reinvestment Plans (DRIPs)

A Dividend Reinvestment Plan (DRIP) is an investment strategy where dividends earned from stocks are automatically reinvested to purchase additional shares instead of being taken as cash. This process allows investors to benefit from compounding as the reinvested dividends generate further returns over time.

How DRIPs Work

- When a company distributes dividends, instead of receiving cash, the investor uses those dividends to buy more shares.

- These additional shares then generate their own dividends, which are further reinvested.

- Over time, this cycle leads to exponential growth in the total number of shares owned and the overall investment value.

Example of DRIP in Action

Consider an investor who buys 100 shares of a company at ₹500 per share, making an initial investment of ₹50,000. The company pays a ₹20 dividend per share annually, and the investor opts for a DRIP to reinvest the dividends.

| Year | Shares Owned | Dividend Per Share (₹) | Total Dividend (₹) | New Shares Bought | Total Shares After Reinvestment |

|---|---|---|---|---|---|

| 1 | 100 | 20 | 2,000 | 4 | 104 |

| 2 | 104 | 20 | 2,080 | 4.16 | 108.16 |

| 3 | 108.16 | 20 | 2,163 | 4.33 | 112.49 |

| 10 | ~180 | 20 | ~3,600 | ~7.2 | ~187.2 |

After 10 years, the investor owns nearly 187 shares without adding any extra money—just by reinvesting dividends. Since dividends are now being paid on a larger number of shares, the annual dividend income keeps increasing, fueling further growth.

This example highlights how DRIPs amplify wealth creation over time, making them an excellent tool for long-term investors.

4.2 Long-Term Growth Investments

Long-term stock market investments harness the power of compounding to achieve significant growth over time. By holding quality stocks for extended periods, investors can benefit from capital appreciation and reinvested earnings, leading to exponential returns.

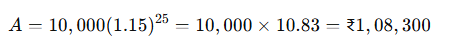

Example: Lump Sum Investment Growth Over 25 Years

Suppose an investor invests ₹10,000 in a stock or mutual fund that provides an annual return of 15%. The investment compounds yearly, meaning each year’s earnings contribute to the following year’s growth.

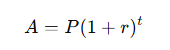

Using the compound interest formula:

Where:

- AAA = Final amount

- PPP = Initial investment (₹10,000)

- rrr = Annual return (15% or 0.15)

- ttt = Number of years (25)

After 25 years:

The investment grows over 10 times its initial value, purely due to compounding and reinvestment of returns.

This example shows that starting early and staying invested can generate massive wealth over time.

4.3 Systematic Investment Plans (SIPs)

Systematic Investment Plans (SIPs) allow investors to contribute a fixed amount regularly (monthly or quarterly) into mutual funds or stocks. This disciplined approach leverages compounding while benefiting from rupee cost averaging to reduce market volatility risks.

Example: Monthly SIP Investment Over 20 Years

Consider an investor investing ₹10,000 per month in a mutual fund that earns an average return of 12% annually.

Using SIP calculation, after 20 years, the investment grows to approximately ₹1.05 crore, while the total invested amount is only ₹24 lakhs.

| Years Invested | Total Amount Invested (₹) | Estimated Portfolio Value (₹) |

|---|---|---|

| 5 | 6,00,000 | 8,23,000 |

| 10 | 12,00,000 | 23,23,000 |

| 15 | 18,00,000 | 50,00,000 |

| 20 | 24,00,000 | 1,05,00,000 |

This demonstrates how consistent investing + time + compounding can transform small contributions into massive wealth.

Both Lump Sum and SIP investments can leverage compounding to achieve financial freedom, but starting early and staying consistent is key.

5. Conclusion

Compounding is one of the most powerful forces in stock investing, enabling investors to grow their wealth exponentially over time. By reinvesting earnings, staying invested for the long term, and leveraging frequent compounding, investors can achieve substantial financial growth.

The key to maximizing the benefits of compounding lies in patience, consistency, and reinvestment. Whether through Dividend Reinvestment Plans (DRIPs), long-term stock investments, or Systematic Investment Plans (SIPs), the earlier one starts, the greater the potential returns.

To build long-term wealth, investors should start investing early, stay disciplined, and allow their investments to compound over time. The sooner you begin, the more time your money has to grow, making compounding a crucial strategy for financial success.